In this video, we will be looking at 5 reasons why international diversification is important. Before we start do you know the story ‘Frog in the Well?’ There was a frog who lived in a well. He spent his entire life at the bottom of the well which was his whole world. He always thought the top of the well is the end of the world. One day the well dries up leaving him no food or water. Hungry & petrified, he musters the courage to discover what beholds after the end of the world. Finally, he manages to leap out of the well and what does he find? Trees, flowers and all kinds of fascinating wonders of the world. The moral of the story is that if you an investor and all your life you have not explored the international markets then you might be missing on the wonders of the world.

India’s economic policies have now made it possible and easier for Mutual Funds to invest in overseas equities. Now Indian residents can also invest directly in international markets. This helps create investors to add another dimension of diversification to their portfolio.

Let us now understand the 5 reasons why international diversification is important.

Reason no.1: An Opportunity to Grow with Foreign Emerging Economies.

If you observe, at a particular time, financial markets around different parts of the world may not be co-related with each other. Some countries may be facing recession due to which their respective stock markets would be on the descend. On the contrary, emerging countries give you the opportunity to get returns at a higher rate.

Reason no.2: Be a part of Global Market-leading MNCs like Apple, Google etc.

We all are familiar with the common saying “Invest in ‘blue chip’ companies like Reliance Industries, Hindustan Unilever, TCS, HDFC etc.” now the same can be applied to the world market. In the past years, it was a distant dream to be a part of or rather invest in world market-leading companies like ‘Apple’, ‘Google’, ‘Amazon’, ‘Walmart’ etc. now this is a reality.

Reason no.3: Take advantage of the ‘Economic Cycles’ across the world.

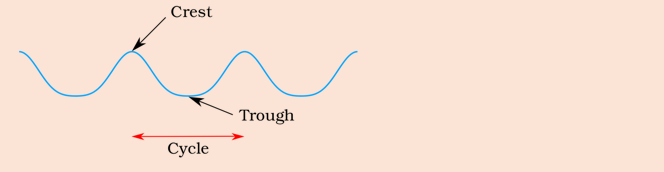

Let us quickly understand an ‘Economical Cycle’.

Consider a sine waveform comprising of a Top & Bottom or Peak & Trough against time. One ‘Economic Cycle’ starts at a relative origin, then expands towards the peak and contracts towards the relative origin, further contracting towards the trough and finally expanding to the relative origin. This completes the cycle. The expansions and contractions happen due to various factors like GDP, interest rates, consumer spending etc. Sounds too technical? Well, the bottom line is that you can take advantage of this by entering into a market where the economic cycle is near the trough i.e. the bottom to get better returns on your investment.

Reason no.4: ‘Rupee Depreciation’ an added Bonus.

Consider an international investment was done in the year 2000. Assume that the sum of the returns in 20 years = X.

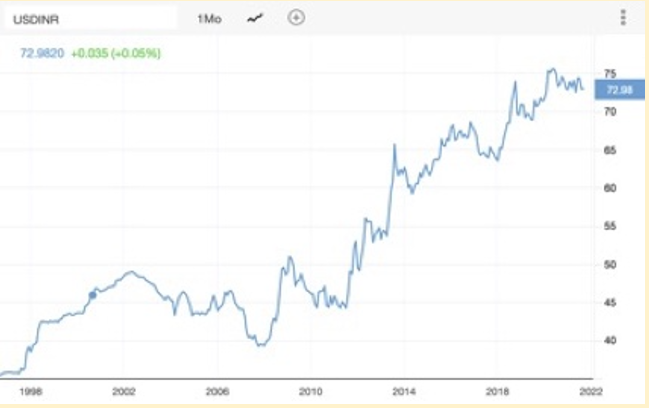

Now let’s take a look at the chart showing the US Dollar rates over the past 20+ years.

In this chart, we can see the gradual depreciation of the rupee over a period of 20+ years, which is ranging from approximately Rs.40 in the year 2000 to

Rs. 70 in the year 2020, which is a growth of almost Rs. 30, i.e. 75% in this case. This gain is an added bonus.

Hence Total Gain = X(sum of all returns in 20 years) + (Rupee Depreciation Bonus)

Reason no.5: Reducing Risks from domestic factors.

Demonetization, GST Act implementation, sudden change in regulation or government policies, Elections, Geo-political conditions etc. are some examples of domestic factors which can cause volatility in the Indian benchmarks. Compare that to US Markets and the indices such as S&P 500 and Nasdaq 100, which has no correlation to Indian benchmarks. Global exposure will help to protect against such domestic factors ultimately reducing the overall risk.

Well, now you know the 5 reasons why international diversification is important, so take the leap and explore the international markets. We hope you have learnt something new today, as it is our constant endeavour at Motilal Oswal to educate & make an ‘investor’ a ‘sound investor’! Happy Investing!