Looking to understand the benefits of long term mutual funds? Here is all you need to know about starting early and staying invested for long term.

We have all heard the famous Albert Einstein quote: “Compound interest is the eighth wonder of the world. He who understands it, earns it; he who doesn’t, pays it”. With long-term investing, compounding can give inflation-beating high returns. With long-term investing, equities can create wealth for you with the magic of compounding and fulfill all your financial goals. This article focuses on the benefits of long term investing.

Benefits of staying invested

When investing in financial products, specifically equity mutual funds, you should have a long-term investment horizon. In the short term, equity markets are volatile and can witness sharp corrections. But, in the long run, equity markets always overcome short-term corrections and recover the losses, and finally go on to make new highs.

Power of compounding: Starting early is the key

If you want to benefit from the power of compounding, you should start investing from early on. If possible, you should start investing right from when you start earning. Let us understand how compounding works for early investors with the help of an example.

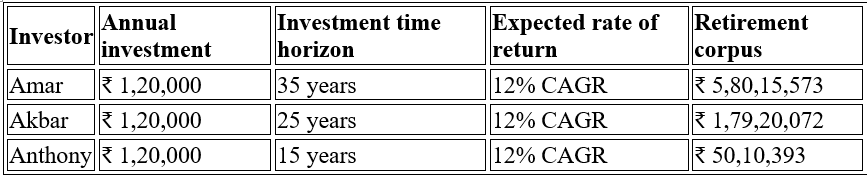

Amar (age 25 years), Akbar (35 years), and Anthony (45 years) start investing ₹10,000 a month (₹1,20,000 annually) for their retirement. They are investing in an equity mutual fund and expecting a return of 12% CAGR. They will invest till the retirement age of 60 years. Let us see how much they are likely to accumulate by retirement (age 60 years).

As seen in the above table, Amar, Akbar, and Anthony invest the same amount every year (₹1,20,000) and expect the same return (12% CAGR). However, the only difference is the investment time horizon.

As Amar starts early at the age of 25, he is likely to accumulate ₹5.8 crores. Amar’s retirement corpus is almost 12 times higher than Anthony’s retirement corpus of ₹ 50 lakhs. Anthony started investing at the age of 45 years, which is 20 years later than Amar. Hence, if you want to create wealth for yourself, you should start early.

Magic of compounding: Long investment time horizon and expected rate of return

In this article, we have explained how the magic of compounding can create wealth for you. Compounding works on two important parameters: long investment time horizon and expected rate of return. A long investment time horizon gives your money enough time to overcome short-term market corrections and benefit from compounding in the long run. Also, when you start early, you can take higher risks and invest in equity mutual funds. They have the potential to give inflation-beating high returns. Thus, investing in equity mutual funds for the long run can give you the benefit of compounding and generating wealth for you.

Disclaimer: This blog has been issued on the basis of internal data, publicly available information and other sources believed to be reliable. The information contained in this document is for general purposes only and not a complete disclosure of every material fact. The information/data herein alone is not sufficient and shouldn’t be used for the development or implementation of an investment strategy. It should not be construed as investment advice to any party. All opinions, figures, estimates and data included in this blog are as on date. The blog does not warrant the completeness or accuracy of the information and disclaims all liabilities, losses and damages arising out of the use of this information. The statements contained herein may include statements of future expectations and other forward-looking statements that are based on our current views and assumptions and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in such statements. Readers shall be fully responsible/liable for any decision taken on the basis of this article.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.