Did you know that according to a report by Mirae, the ETF market’s AUM globally rose to $82 billion in 2022 from $75 billion in 2021? Despite sharp growth in popularity, for many new investors, the world of ETFs or Exchange-Traded Funds can seem like an uncharted territory filled with perplexing jargon.

Wondering what is ETF? With a desire to grow your wealth but tangled in the web of financial terminologies, then this blog is your beacon. Let’s begin your financial journey with a deep dive into the sea of ETFs.

Imagine stepping into a supermarket and instead of buying individual groceries, you get a pre-packed basket with a mix of essentials. This is what an ETF or an Exchange-Traded Fund, offers in the realm of investments. It’s like a basket of diverse investments traded on an exchange, just like a stock.

But why should you, a beginner investor, consider adding ETFs to your financial shopping cart? Let’s unwrap the ETF package together.

Breaking down what is ETF fund.

An Exchange Traded Funds, more commonly known as an ETF, is a form of investment fund and exchange-traded product that is traded on a stock exchange.

Just like a mutual fund, an ETF pools funds from many investors and uses it to purchase a diversified portfolio of assets, such as stocks, bonds and commodities.

However, ETFs offer something unique that sets them apart from mutual funds – the ability to be traded throughout the day like an individual stock.

Mutual funds are purchased or sold at the end of the trading day at the net asset value (NAV) price. In contrast, ETFs are bought and sold throughout the day at market prices, providing investors with flexibility and liquidity.

The concept of liquidity is essential in investment. To understand why let’s consider an example. Suppose you buy a piece of land as an investment. However, if an emergency arises and you need to sell the land quickly for cash, you might not be able to do so immediately.

You may have to wait for days, weeks or even months to find a suitable buyer. In financial terms, this lack of readily available buyers and sellers is known as low liquidity.

However, ETFs, being exchange-traded, tends to offer high liquidity. This means that you can buy or sell them almost instantly during market hours, similar to stocks. This liquidity, combined with the diversification of an investment fund, makes ETFs a popular choice among investors.

How do Exchange Traded Funds (ETFs) Work?

Just like any other funds, ETFs work by pooling the investments of numerous investors and buying assets on their behalf. However, the operation of ETFs has a unique twist. Each unit of an ETF represents a bundle of assets, such as shares of stock, bonds or commodities, mirroring a particular index.

The index can be broad like the Nifty 50, which comprises 50 of the largest Indian companies or more specialized, like a sector-specific index.

While an ETF tracks an index, it doesn’t always hold every single asset in the index. Instead, the ETF uses a technique called “sampling” to create a portfolio that closely reflects the performance of the index.

Moreover, unlike mutual funds, Exchange Traded Funds have market makers – typically large broker-dealers that agree to ensure that the ETF stays liquid. These market makers can create and redeem “creation units,” which are large blocks of ETF shares (usually 50,000 to 100,000 shares), to manage supply and demand and help the ETF’s market price stay close to its NAV.

Types of ETFs

ETFs are as diverse as a bustling Indian bazaar. They cater to different segments of the market, reflecting the vast landscape of available investment options. Depending on the asset class they focus on, ETFs can be broadly classified into several categories:

Sector ETFs

These ETFs focus on specific sectors of the economy such as technology, healthcare, and financial services, among others. They allow investors to invest in a particular sector without having to buy individual stocks. For example, if you believe that the technology sector in India is set to grow, investing in a tech sector, ETF can be a smart move.

Commodity ETFs

Commodity Exchange Traded Funds provide exposure to various physical commodities like gold, silver, crude oil and agricultural products. Investing in these ETFs allows you to benefit from the price movements of these commodities without actually owning them.

Bond ETFs

These ETFs provide exposure to the fixed-income market by investing in bonds. They offer a convenient way for investors to add bonds to their portfolios without buying individual bonds.

International ETFs

These ETFs offer exposure to foreign markets, allowing investors to diversify their portfolios beyond Indian markets. For instance, an international ETF could offer exposure to the US or European stock markets, providing a hedge against domestic market volatility.

Thematic ETFs

Thematic ETFs are centred around a specific theme or trend such as clean energy, artificial intelligence, or e-commerce. These ETFs allow investors to gain exposure to sectors or industries they believe will outperform the broader market over the long term.

The variety of ETFs on offer allows investors to build a portfolio that suits their risk tolerance, investment goals and interests.

Benefits of Investing in ETFs

Just like a buffet offers a variety of dishes to cater to different tastes, investing in ETFs comes with a host of benefits. These include:

- Diversification: ETFs offer instant access to a diverse range of securities. This can reduce the risk associated with investing in individual stocks or bonds. As the old adage goes, “Don’t put all your eggs in one basket.”

- Liquidity: ETFs are traded on stock exchanges and can be bought and sold throughout the trading day, offering investors high liquidity.

- Transparency: ETFs disclose their holdings daily, which provides investors with transparency. You know exactly what assets are in the ETF you’re investing in.

- Lower Costs: ETFs generally have lower expense ratios compared to mutual funds. This is because most ETFs are passively managed, aiming to replicate the performance of an index rather than actively trying to outperform it.

- Flexibility: ETFs offer investors the flexibility to implement a variety of investment strategies, such as short selling or buying on margin.

While ETFs offer several benefits, it’s also essential to understand the associated risks.

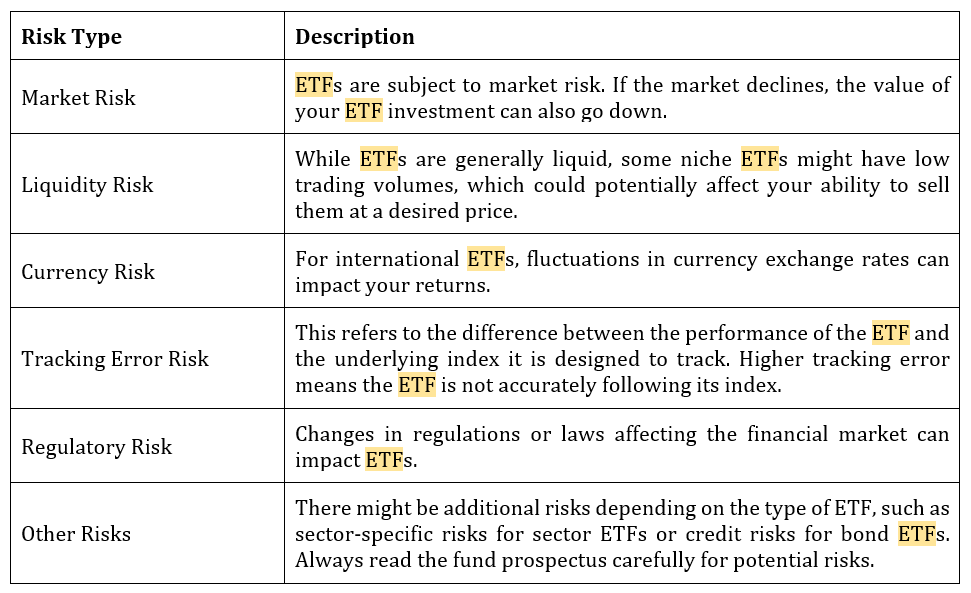

Risks of Investing in ETFs

How to Invest in ETFs: A Step-by-step Guide

Step 1: Open a Demat and Trading Account

You will need a Demat and trading account with a broker to trade ETFs. You can open these accounts online with minimal documentation.

Step 2: Research and Choose Your ETFs

Just like when you shop for groceries, you need to choose the right ETFs based on your financial goals, risk tolerance and investment horizon.

Step 3: Place the Order

Once you have selected the ETF, you can place the buy order through your trading account. Specify the number of units you want to purchase and at what price.

Step 4: Monitor Your Investment

After making the purchase, it’s important to monitor your ETFs to ensure they are performing as per your expectations.

How are ETFs Taxed in India?

The taxation of ETFs in India largely depends on the type of assets they hold and the duration for which they are held:

- Equity ETFs: If held for less than 12 months, any gains are considered short-term capital gains and are taxed at 15%. If held for more than 12 months, gains are treated as long-term capital gains and are taxed at 10% for gains exceeding INR 1 lakh.

- Debt ETFs: Regardless of the holding period, any gains from debt ETFs are taxed at the applicable income tax slab rate of the investor. This is a departure from the previous rule where short-term gains (less than 36 months) were taxed as per the slab rate, and long-term gains (more than 36 months) were taxed at 20% with indexation benefits. The new rule stipulates that all gains, short-term or long-term, are taxed according to the investor’s tax slab.

- Gold ETFs: Similar to debt ETFs, if gold ETFs are held for less than 36 months, any gains are taxed as short-term capital gains as per the investor’s income tax slab. If held for more than 36 months, gains are considered long-term capital gains and are taxed at 20% with indexation benefits.

For example, if you invested INR 1 lakh in an equity ETF and sold it after 13 months for INR 1.2 lakh, you would have a long-term capital gain of INR 20,000. As the gain is less than INR 1 lakh, no long-term capital gains tax would be due.

Disclaimer: The information provided on taxation is for general informational purposes only and should not be relied upon as tax advice. Consult a qualified tax professional for personalised guidance regarding your specific tax situation. Use of this information is at your own risk, and we disclaim any liability for errors or omissions.

Final Thoughts

As we stand at the crossroads of this comprehensive guide, you should now have a solid understanding of Exchange Traded Funds – their definition, working mechanism, benefits, popular options in India and their taxation rules. Remember, though, that the key to successful investing lies not just in knowledge but in implementing that knowledge strategically.

ETFs offer a blend of diversification, flexibility and transparency that few other investment vehicles can match. They act as the bridge connecting you to the wider stock market, all the while keeping the costs low and maintaining transparency. In a nutshell, ETFs can be a worthy addition to your financial portfolio.

As a beginner, you might still have many questions or doubts. That’s perfectly fine. It’s always better to ask questions than to make uninformed decisions. So, don’t hesitate to consult with a financial advisor or an investment firm to know what is ETF and clear your doubts.

Disclaimer: This blog has been issued on the basis of internal data, publicly available information and other sources believed to be reliable. The information contained in this document is for general purposes only and not a complete disclosure of every material fact. The information/data herein alone is not sufficient and shouldn’t be used for the development or implementation of an investment strategy. It should not be construed as investment advice to any party. All opinions, figures, estimates and data included in this blog are as on date. The blog does not warrant the completeness or accuracy of the information and disclaims all liabilities, losses and damages arising out of the use of this information. The statements contained herein may include statements of future expectations and other forward-looking statements that are based on our current views and assumptions and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in such statements. Readers shall be fully responsible/liable for any decision taken on the basis of this article.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.