Imagine this: You diligently save and invest your hard-earned money, confident that it will eventually grow over time. But here’s the thing – simply investing isn’t enough. To truly harness the potential of your money, you need to understand the remarkable force that lies within compound interest. In this blog, we will delve deep into how compound interest works and more importantly, how to calculate compound interest online.

What is compound interest?

When you put your money in a savings account or invest it, you earn something called “interest.” Interest is basically extra money that is added to your original amount. With compound interest, not only do you earn interest on your initial investment, but you also earn interest on the interest you’ve already earned.

Let’s say you have ₹10,000 in a savings account with a 5% annual interest rate. At the end of the first year, you would earn ₹500 in interest (5% of ₹10,000). Now the ₹10,500 becomes the new starting point for the next year.

So, in the second year, you earn interest not only on your initial ₹10,000 but also on the additional ₹500 you earned in interest. This means you would earn ₹525 in interest (5% of ₹10,500).

As time goes on, this cycle of earning interest on both your original amount and the accumulated interest continues, causing your money to grow faster. The longer you keep your money invested, the more substantial the effect of compound interest becomes.

But the question remains, how to calculate compound interest? Well, you can either calculate compound interest online or even do it manually. Before we understand how a compound investment calculator works, let’s know how it can benefit us.

Advantages of compound interest calculator

A Compound investment calculator provides numerous advantages that make it a valuable tool for financial planning. Here are some major pros:

1. Accuracy: Compound interest calculations can be intricate and prone to errors when performed manually. By using a compound interest calculator, you can ensure precise and accurate results, eliminating human calculation mistakes.

2. Time-saving: Manual calculations involving compound interest formulas can be time-consuming, especially when dealing with complex scenarios or multiple variables. With a compound interest calculator, you can obtain instant results, saving you valuable time and effort.

3. Flexibility: Compound interest calculators allow you to input various parameters such as principal amount, interest rate, compounding frequency, and time period. This flexibility enables you to experiment with different scenarios, compare outcomes, and make informed decisions about your financial goals.

How to calculate compound interest online with Motilal Oswal

You don’t need to calculate compound interest manually. By using the Motilal Oswal compound interest calculator, one can easily calculate interest or profit accumulated on their investments over time. Here’s how you use it:

Step 1: Enter Your Monthly Investment

Step 2: Enter Expected Rate of Return

Step 3: Enter Investment Period

Let’s say your monthly investment is ₹5000, ERR is 8%, and the investment period is 10 years. After 10 years, you will accumulate an aggregate amount of ₹9,54,851. On your investment of ₹6 lakhs, you earned a profit of ₹3,54,851.

When you calculate compound interest online, it becomes easy to estimate your future investment value in a matter of seconds.

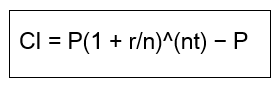

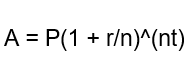

Compound Interest Formula

Instead of using the compounding calculator, one can also manually calculate the compound interest using the given formula:

Here:

A = the future value of the investment, including interest

P = the principal amount (initial investment)

r = annual interest rate (as a decimal)

n = number of times interest is compounded per year

t = number of years the money is invested

This formula calculates the compound interest of your investments over time.

Let’s understand this with an example:

If the principal amount is ₹10,000, the annual interest rate is 8%, and the investment is made for 10 years, we can calculate the compound interest using the formula:

Where:

P = ₹10,000 (principal amount)

r = 8% (annual interest rate = 0.08)

n = 1 (assuming interest is compounded annually)

t = 10 (number of years)

Substituting these values into the formula:

A = ₹10,000(1 + 0.08/1)^(1*10)

Using a calculator or spreadsheet, we can evaluate this expression to find the future value:

A ≈ ₹21,589.48

Therefore, the future value of the investment after 10 years with a principal amount of ₹10,000 and an annual interest rate of 8% is approximately ₹21,589.48.

If you are serious about investing, a compound interest calculator is a valuable tool that can help you plan out your investments and reach your financial goals.

Here are some additional tips for making the most out of compound interest:

- Be pragmatic about your investment goals. Don’t expect to get rich quickly. Compounding works best over the long run.

- Start saving early. The earlier you start saving, the more time your money gets to compound.

- Invest regularly. The more often you invest, the more time your money has to grow through compound interest.

- Reinvest your earnings. When you earn interest on your investments, reinvest those earnings so that they can continue to grow.

Conclusion

By harnessing the power of compound interest, your money can grow significantly over time. It accumulates and multiplies, helping you reach your financial goals sooner. By following the aforementioned steps, you can either calculate compound interest online or do it manually. Remember, the key is to start early and allow your money to compound over a long period, as the longer your money remains invested, the more it can grow.

FAQs

1. What is compound interest?

Compound interest is a financial concept that refers to the calculation and addition of interest not only on the initial principal amount but also on the accumulated interest from previous periods. It is a compounding process where the interest earned becomes part of the principal, leading to exponential growth over time.

2. How will compound interest calculator help me plan out my investments?

A compound interest calculator can help you manage your finances by showing you how much your invested savings can grow over time. When you calculate compound interest online, it can help you make strategic decisions about how much to invest and how long to invest for.

3. Is monthly compounding or annual compounding better?

Monthly compounding is generally considered better. With monthly compounding, the interest is calculated and added to your savings account balance more frequently, resulting in slightly higher overall returns compared to annual compounding.

Plagiarism: inevitable