Momentum investing is a strategy that invests in securities that have momentum (usually upward trending prices) and looks to sell them once they lose momentum. It works under the hypothesis that markets will continue to move in a particular direction for a much longer period than most people assume is possible. It implies that well-performing securities will continue to do so & vice versa.

The momentum for a security is decided basis the price trend. Since all decisions revolve around price, for momentum, ‘Price is the almighty’ or popularly known as ‘Bhaav bhagwaan che’.

“The premier market anomaly is momentum. Stocks with low returns over the past year tend to have low returns for the next few months, and stocks with high past returns tend to have high future returns.”

– Eugene Fama and Ken French (fathers of Efficient Market Hypotheses)

Does Momentum work?

Is the momentum strategy bang for the buck? A good starting point will be to look at the historical performance & the consistency of the returns. In Exhibit 1 we can see that momentum has outperformed broad-based equity across different periods. In longer-term periods, the out performance is significant, particularly over a period of 10 years.

Exhibit 1

| Index Performance | |||||

| Index | 1 year | 3 year | 5 year | 10 year | 15 year |

| Momentum | 75.20% | 33.70% | 35.90% | 25.70% | 23.80% |

| Equity Markets | 27.80% | 17.90% | 18.90% | 13.80% | 13.20% |

| Outperformance | 47.40% | 15.80% | 17% | 11.90% | 10.60% |

Momentum = Nifty500 Momentum 50 Total Return Index

Equity Markets = Nifty 50 Total Return Index

Source/Disclaimer:MOAMC Research, NSE; Data as of 31-Jul-2024. The information / data herein alone is not sufficient and should not be used for implementation of an investment strategy. The table/charts mentioned above are used to explain the concept and is for illustration purpose only It should not be construed as an investment advice to any party. Past performance may or may not be sustained in future and is not a guarantee of any future return

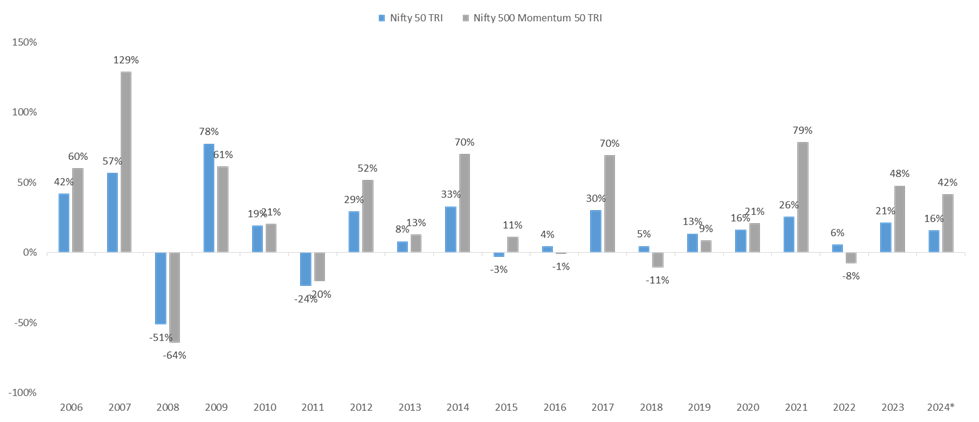

Exhibit 2

Momentum = Nifty500 Momentum 50 Total Return Index

Equity Markets = Nifty 50 Total Return Index

Source/Disclaimer: niftyindices. Performance as of close of 31-Dec-06 to 31-Jul-24. *2024 till year to date. Performance results have many inherent limitations and no representation is being made that any investor will, or is likely to achieve. Past performance may or may not be sustained in future and is not guarantee of any future returns. The above graph is used to explain the concept and is for illustration purpose only and should not used for development or implementation of an investment strategy.

As shown in Exhibit 2, the momentum strategy has outperformed the broad-based Nifty 500 index in 12 out of the last 19 years. Both the exhibits clearly show that the strategy has worked historically in the Indian markets & investors should have a look at it.

Is it the perfect strategy then?

Momentum is not perfect & does have its limitations. As the strategy picks up securities with the highest motion/momentum, historically it is observed that such strategies experience higher volatility. Further, such strategies fall more during market corrections (downtrend) compared to broad-based equity. Since this is a trend based strategy, it has to strictly follow market movements which results in higher portfolio churn. The best way to address these is to invest with a fairly long term investment horizon.

To conclude, momentum has performed well in the past & may continue to do so as long as it can take advantage of the mispricing in the market. Studies show that it has worked across various markets & in India, it is becoming increasingly popular among investors. Such a strategy is best suited for a long term investor. Considering the risks, momentum has the potential to deliver returns in the long term.

Disclaimer: This publication is pursuant to Investor Education and Awareness Initiative by Motilal Oswal Mutual Fund. This shall not be construed as offer to invest in any financial product or Scheme. The objective of this publication is restricted to informational purposes only. All investors have to go through a one-time KYC (Know Your Customer) process. For further details on KYC, Change of address, phone number, bank details etc. list of SEBI registered Mutual Funds and redressal of complaints including details about SEBI SCORES portal, visit link https://www.motilaloswalmf.com//New_Page/KYC-and-Redressal-of-Complaints/9. SMART ODR portal, visit link https://smartodr.in/login. Investors should invest only with SEBI registered Mutual Funds details of which can be verified on the SEBI website under “SEBI Intermediaries/ Market Infrastructure Institutions.

This blog has been issued on the basis of internal data, publicly available information and other sources believed to be reliable. The information contained in this document is for general purposes only and not a complete disclosure of every material fact. The information/data herein alone is not sufficient and shouldn’t be used for the development or implementation of an investment strategy. It should not be construed as investment advice to any party the blog does not warrant the completeness or accuracy of the information and disclaims all liabilities, losses and damages arising out of the use of this information. Mutual Funds are subject to market risk. Read the offer documents before investing. Readers shall be fully responsible/liable for any investment decision taken on the basis of this article.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.