Although mutual funds involve high risks but also offer various means to minimize them. Various schemes these days are available for investors that help them surpass the risk based on their risk profile. If you also have been looking for a safer way to invest in mutual funds, banking & PSU debt funds might be just what you are looking for.

What are Banking & PSU funds?

The Banking and PSU funds are short-term debt funds. These funds offer decent returns and minimize risk by investing in top-rated debt instruments containing securities predominately issued by banks and public sector undertakings. As per SEBI guidelines for mutual funds, banking and PSU Funds invest at least 80% of their assets in debt instruments issued by such institutions. As a result, these funds have superior credit quality compared to other debt funds. Banking and PSU funds maintain an optimum balance between liquidity, safety, and yield.

Who should invest in banking & PSU funds?

Banking & PSU funds are short-term debt funds ideal for investing for 1-2 years. These funds carry a lower risk than other debt funds, so they are quite safe for investment. Conservative investors who want to play safe may benefit from banking and PSU funds. Not only conservative investors but aggressive and moderate aggressive investors can enjoy the stability of these funds while competing with other aggressive funds.

All in all, banking & PSU funds are ideal for investors who are seeking,

- Lower-risk investment options: Having less susceptibility to market volatility, these funds can be a good option for investors who are looking for short-term investments with low risk.

- Higher returns: These funds usually provide higher returns than FD. If you are looking for alternative options to bank deposits, you may opt for this mutual fund scheme.

- Short-term investment options: Banking & PSU funds are short-term funds with a maturity period of 1-2 years.

- High liquidity and credit quality: These funds invest in AAA-rated debt instruments. Hence they have high liquidity and superior credit quality. You can invest in these schemes based on your investment objective and financial goal.

Taxation on gains from Banking & PSU Funds

Banking & PSU Funds get taxed as the taxation norms of debt funds. The capital gains realized from these funds are taxed based on how long the investor holds fund units.

If an investor redeems the units before three years, the gains on redemption/sale will fall into the category of short-term capital gains and get taxed as per the investor’s income tax slab rate. Suppose an investor has made a short-term capital gain of Rs 50,000 on investment by withdrawing the amount before three years. So this Rs 50,000 will be added to their taxable income and taxed accordingly.

If the investor redeems the units after three years, the capital gains are considered a long-term gain and taxed at 20% with indexation benefit. Indexation benefit means the purchase prices are increased as per the inflation to calculate capital gains. Note that indexation reduces the value of overall long-term capital gains to show the effect of inflation on your investment.

The risk associated with banking & PSU funds

While these funds are relatively safe, they come with a fair share of risk. If you closely observe the debt market, you will see an inverse relationship between banking & PSU funds and interest rates. The interest rate movement has a lot to do with the performance of these funds. If the interest rate increases, the price of Banking & PSU funds decreases. As a result, the investor’s returns on investment get impacted.

Return potential of banking & PSU fund

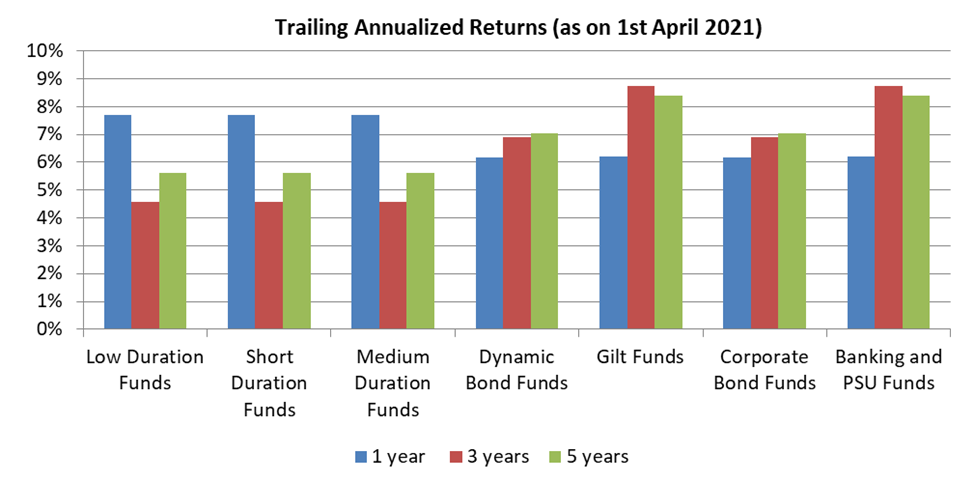

These funds offer relatively higher & comparatively stable returns to investors in the short term and with limited risks and hence if you are willing to take a little risk and want an alternative to FDs, Banking and PSU funds are funds you might want to explore.

Source: https://www.miraeassetmf.co.in/campaigns/banking-and-psu-debt-funds

However, when the interest changes or increases, these funds may get impacted and not generate high returns. Market volatility can also be a factor that can impact returns. Make sure you consider market conditions and risk appetite before investing.

Advantages of banking & PSU fund

Banking & PSU fund entails a lot of benefits that investors can enjoy through this investment, such as

- High Liquidity: These funds invest in top AAA-rated instruments, making them highly liquid and enabling investors to cash out their money in emergencies. Furthermore, adequate liquidity of banking & PSU funds allows fund managers to leverage their power to execute more trades.

- Low Risk: Investment under these funds is for a short duration, so they are less impacted by market volatility, which works best for investors seeking lower-risk investments. These funds are not risk-free but comparatively less risky than other debt funds.

- High Returns: These funds have a better potential to offer higher returns than savings accounts or fixed deposits. These funds are for investors looking for steady returns in a short duration. Investors with a low-risk appetite and specific investment horizon can select banking & PSU funds instead of fixed deposits as they are much more likely to perform better.

Why should you invest in banking & PSU fund?

Banking and PSU funds for the most part offer higher returns than savings accounts or fixed deposits. The shorter duration of these funds helps investors reduce the market volatility and achieve better returns than other debt funds. With these funds, investors can also benefit from capital appreciation in case of interest rate declination. Besides, these funds are also highly liquid and thus provide investors easy access to money in case of emergencies. If you are a risk-averse investor who is looking for relatively steadier returns in a short time horizon, make sure you plan to invest in Banking and PSU funds.

Conclusion

Banking and PSU funds are safer than many other debt funds. However, they require proper research and valuation of factors such as risks, history of returns, investment horizon, fund manager’s performance, etc. Make sure you consider all such factors before investing in mutual funds.

FAQs

Are you confused about some aspects of investing in banking & PSU fund investment? These FAQs will answer your queries.

- Is banking & PSU fund investment a safe option?

- Ans: Yes, banking & PSU debt schemes are comparatively safer as they invest in entities of banks and PSUs that are government-backed or owned and don’t have credit risk.

- Does banking & PSU fund come with a lock-in period?

- Ans: No. These funds do have a lock-in period. They are highly liquid and suitable for investors with a shorter investment horizon.

- How to invest in banking & PSU funds?

- Ans: To invest in these funds, you can either visit the AMC website and select your preferred fund or take assistance from a broker or intermediary platform and invest through SIP or lump sum.

- How do banking & PSU funds allocate their assets?

- Ans: Banking and PSU Funds invest at least 80% of their assets in debt instruments of banks, public financial institutions, and public sector undertakings.

Disclaimer: This blog has been issued on the basis of internal data, publicly available information and other sources believed to be reliable. The information contained in this document is for general purposes only and not a complete disclosure of every material fact. The information/data herein alone is not sufficient and shouldn’t be used for the development or implementation of an investment strategy. It should not be construed as investment advice to any party. All opinions, figures, estimates and data included in this blog are as on date. The blog does not warrant the completeness or accuracy of the information and disclaims all liabilities, losses and damages arising out of the use of this information. The statements contained herein may include statements of future expectations and other forward-looking statements that are based on our current views and assumptions and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in such statements. Readers shall be fully responsible/liable for any decision taken on the basis of this article.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.