Investment Guru Warren Buffett has said once “It is not important when you enter the market BUT how long you stay invested”

“Time in the market” v/s “Timing the market” can be understood as the difference between Investing and Speculating. Timing the market is similar to Speculating, where one wants to take advantage of the price movement, it is a bet on the future price. Whereas the Time in the market is about Investing where you let the quality of the asset and the power of compounding work in your favour.

Let us see how timing the market does not work, or simply put is it even possible?

It is futile to try to time the market

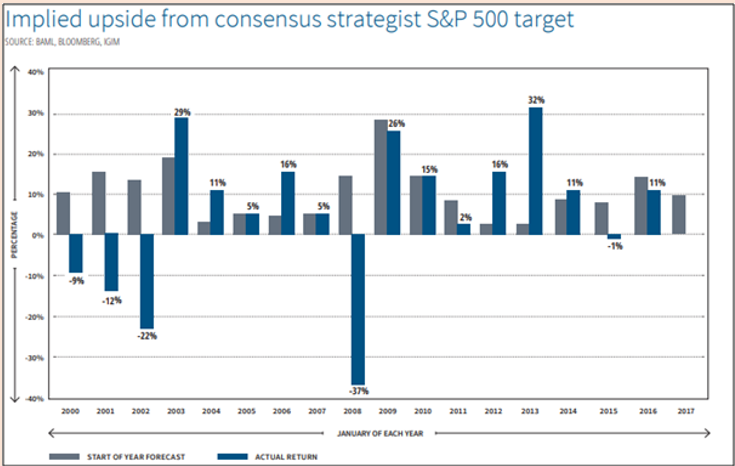

When you try to time the market you tend to get carried away by the consensus opinion or hype created by the media and the analysts. But do they know it all?

Source: Bloomberg

This graph shows the difference between consensus forecast and the actual return of S&P 500. As you can see, there is a huge disparity between what the experts thought on market return and the actuals, especially in the years 2000, 2001-02 and 2008. So timing the market using the opinions and consensus is not going to improve your performance.

Missing the handful high Return Days

Timing the market is very vulnerable to the handful of good days and bad days in the market. Markets will either spurt sharply or correct sharply, and in the process of timing the market if you miss out on these good days or if you happen to buy on the bad days, your timing concept can grossly underperform.

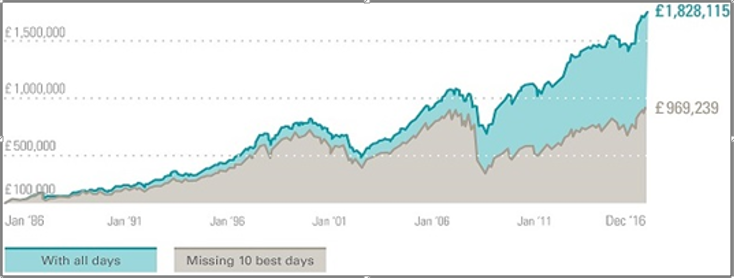

Source: FTSE

Above study of 30 years of FTSE in UK, shows that compared to being invested in the market for all Days, if a trader misses just the “10 Best Days” in 30 years, his absolute returns would have been halved.

In another similar study on S&P, it is proven that missing “30 Best Days” in a 20 year period, would result into a NEGATIVE return, and the investor would lose money instead of making money.

So, when an investor invests to grow his wealth in the long term, he buys securities without trying to guess when the market will be at its lowest and highest point. Focus is on buying Quality, doing adequate research on the stock or the mutual fund performance and keeping the asset allocation ratios in line with the financial goals thereby reaping the benefits of long term compounding. A person trying to time the market, on the contrary, is caught with making short term predictions about price movement alone, missing out on more value adding parameters for wealth creation.

Lastly, Transaction costs such as brokerage, statutory taxes, exit loads in Mutual funds etc. plays negatively to a timing strategy. When you add all these up the actual economics of timing the market can change quite drastically.

It is said that in the short run the stock market is a slotting machine but in the long run the stock market is a weighing machine. Over a longer period of time, quality stocks held on tend to outperform any kind of aggressive strategy for timing the market.

We hope you have learnt something new today, as it is our constant endeavour to educate and make an ‘investor’ a ‘sound investor’! Happy Investing!

The Time in the market is about Investing: https://www.motilaloswal.com/blog-details/Why-does-time-in-the-market-matter-more-than-timing../1769