Hello friends, If you are curious about mutual funds and want to learn about how the performance of a particular Mutual fund is calculated, you need to know what is mutual fund’s Net Asset Value or NAV in short is.

Mutual Funds invest the money collected from investors in securities markets, whether stocks or debt instruments. And since the market value of these securities change on a daily basis, the NAV of the fund also varies on a daily basis. NAV ensures the fund provides an equitable distribution of returns across all its unit holders.

Let us view the Definition of NAV. Net Asset Value (NAV), is the market value of all securities held by the mutual fund scheme minus its liabilities, divided by the total number of outstanding units, on a given day.

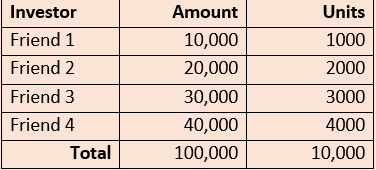

Let us understand NAV through an example: Assume a pool of money from 4 friends, each friend putting in different amounts of money. MF issues Rs.10/- notional value Units to the 4 investors

Total number of units = 10,000

NAV is Rs. One Lakh divided by 10,000 units = Rs. 10/-

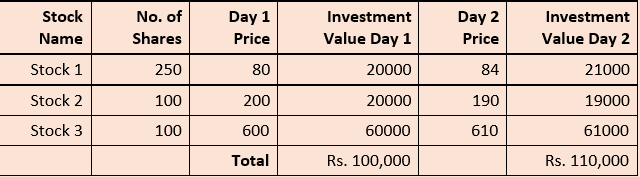

Mutual Fund invests this money in shares of 3 companies and see how their investment value change from Rs. 1 Lakh on Day 1 to Rs. 1.1 Lakh on Day 2:

NAV = Investment Value on given day divided by number of units

Therefore the NAV of the fund changes from Rs. 10 on Day 1 to Rs. 11 on Day 2.

So, anyone buying the above Mutual Fund units on Day 1 needs to buy it at a cost of Rs. 10 per unit (its NAV on Day 1), and the person selling the Mutual Fund on Day 2 gets to sell it at a price of Rs. 11 per unit (its NAV on Day 2).

Changes and declaration of net asset value: As every stock price goes up and down or fluctuates every single second, so should the Net Asset Value of that particular mutual fund. For most of the mutual funds, NAV is declared at the end of the day after the market closes at 3:30 p.m.

Other factors that influence a fund NAV are fund expenses, dividend pay-outs, new investment into the Mutual fund and redemption of existing units. Do remember that when you buy or sell a mutual fund, NAV depends upon the cut-off time your broking platform allows to get the same day NAV.

Importance and uses of NAV: Just like the stock price, if we track the NAV of any mutual fund, we get to know about its performance over the time.

We hope you have learnt something new today, as it is our constant endeavour to educate and make an ‘investor’ a ‘sound investor’! Happy Investing!

This publication is pursuant to Investor Awareness Initiative by Motilal Oswal Mutual Fund. This shall not be construed as offer to invest in any financial product or Scheme. The objective of this publication is restricted to informational purposes only. All investors have to go through a one-time KYC (Know Your Customer) process. For further details on KYC, Change of address, phone number, bank details etc. list of SEBI registered Mutual Funds and redressal of complaints including details about SEBI SCORES portal, visit link https://www.motilaloswalmf.com//New_Page/KYC-and-Redressal-of-Complaints/9. Investors should invest only with SEBI registered Mutual Funds details of which can be verified on the SEBI website under “SEBI Intermediaries/ Market Infrastructure Institutions. Mutual Fund Investments are subject to market risks, read all scheme related documents carefully”.

Voice-over reiteration of “Mutual Fund investments are subject to market risks, read the offer document carefully before investing”