If one seeks safety returns are too low

If one seeks better returns, risks are too high.

Did I miss the bottom?

Are there more shocks yet to come?

I have seen below inflation returns for the last 10 years.

Will the cycle turn and if so how soon?

Is the rally already over?

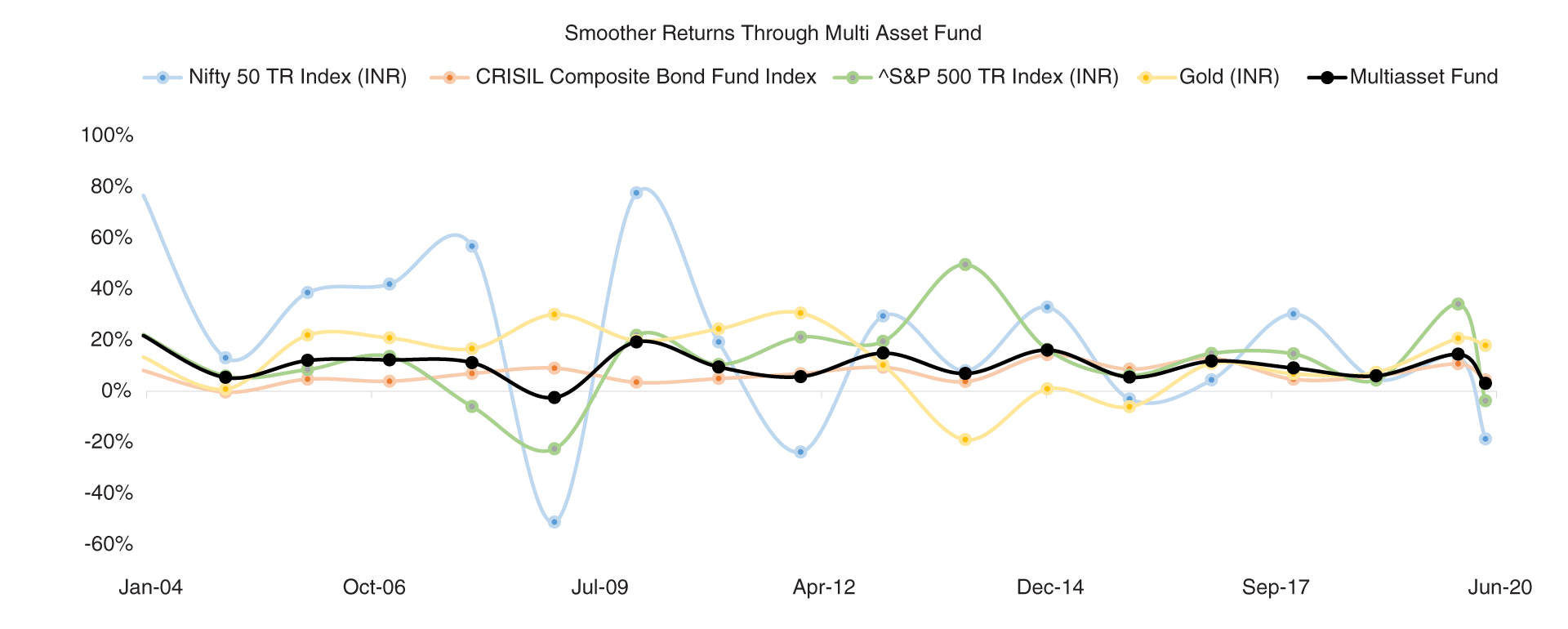

Source: Bloomberg and MOAMC Internal research. *Data for CY20 is updated till June 30, 2020

Disclaimer: The above graph is used to explain the concept and is for illustration purpose only and should not used for development or implementation of an investment strategy. Past performance may or may not be sustained in future.

Why Multi Asset Fund?

A single asset class has periods of outperformance and periods of drawdowns.

How does a Multi Asset Fund work?

Using a mix of non-correlated asset classes yields a combination which has far lesser volatility and comparatively better risk adjusted returns.

What is on offer?

A diversified multi asset fund which aims to generate long term capital appreciation by investing in multiple asset classes a with lower volatility, yet aiming for reasonable returns.

The above is for illustration purpose only. The actual result may vary from depicted results depending on scheme selected. It should not be construed to be indicative of scheme performance in any manner. Past performance may or may not be sustained in future.

Source: MOAMC internal analysis The above Table is used for illustration purpose only and should not used for development or implementation of an investment strategy

| Name of the Scheme | Motilal Oswal Multi Asset Fund (MOFMAF) | |||

| Type of the Scheme | An open ended scheme investing in Equity, International Equity Index Funds/ Equity ETFs, Debt and Money Market Instruments and Gold Exchange Traded Funds | |||

| Category of the Scheme | Multi Asset Allocation | |||

| Investment Objective | The investment objective is to generate long term capital appreciation by investing in a diversified portfolio comprises of Equity, International Equity Index Funds/ Equity ETFs, Debt and Money Market Instruments and Gold Exchange Traded Funds. However, there can be no assurance or guarantee that the investment objective of the Scheme would be achieved. | |||

| Benchmark | 30% Nifty 50 TRI + 50 % Crisil Short Term Gilt Index + 10% Domestic Price of Gold + 10% S&P 500 Index (TRI) | |||

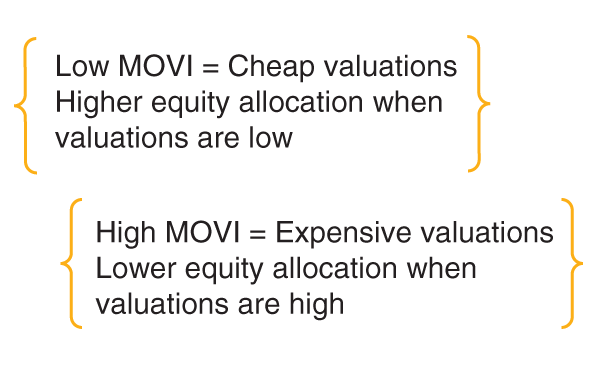

| MOVI | Motilal Oswal Value Index (MOVI) is a proprietary index of Motilal Oswal Asset Management Company Limited (MOAMC). It is calculated taking into account Price to Earnings (P/E), Price to Book (P/B) and Dividend Yield of the Nifty 50 Index. The MOVI is calculated on 30 Daily Moving Average of the above parameters. A low MOVI level indicates that the market valuation appears to be cheap and one may allocate a higher percentage of their investments to Equity as an asset class. A high MOVI level indicates that the market valuation appears to be expensive and that one may reduce their equity allocation.

NSE Indices Ltd. (NSE) is the calculating agent of NIFTY MOVI. NSE shall calculate, compile, maintain and provide NIFTY MOVI values to Motilal Oswal Asset Management Company Ltd. NIFTY MOVI values will be published on the MOAMC website on a daily basis. |

|||

| Plans | The Scheme has two Plans: (i) Regular Plan and (ii) Direct Plan Regular Plan is for Investors who purchase/subscribe units in a Scheme through any Distributor (AMFI Registered Distributor/ARN Holder). Direct Plan is for investors who purchase/subscribe units in a Scheme directly with the Fund and is not routed through a Distributor (AMFI Registered Distributor/ARN Holder). |

|||

| Options | Each Plan offers Growth Option. | |||

| Minimum Investment | Rs. 500/- and in multiples of Re. 1/- thereafter. | |||

| Load Structure | Entry Load: Nil Exit Load: 1%- If redeemed on or before 3 months from the date of allotment. Nil- If redeemed after 3 months from the date of allotment. |

|||

| Fund Manager | Fund Manager - Equity Component | Fund Manager - Debt Component | Fund Manager - International Equity | Fund Manager - Gold |

| Mr. Siddharth Bothra | Mr. Abhiroop Mukherjee | Mr. Herin Visaria | Mr. Swapnil Mayekar | |

| Experience: 18 years | Experience: 11 years | Experience: 11 years | Experience: 11 years | |

| Product Labeling |

|

| This product is suitable for investors who are seeking | |

| 1) Long term capital appreciation by investing in a diversified portfolio. | |

| 2) Investing in Equity, International Equity Index Funds/ Equity ETFs, Debt and Money Market Instruments and Gold Exchange Traded Funds | |

| *Investors should consult their financial advisers if in doubt about whether the product is suitable for them. |

| Type of the Scheme | An open-ended dynamic asset allocation fund | |||||||||||||||||||||||

| Category of the Scheme | Dynamic Asset Allocation | |||||||||||||||||||||||

| Investment Objective | The investment objective is to generate long term capital appreciation by investing in equity and equity related instruments including equity derivatives, debt, money market instruments and units issued by REITs and InvITs. | |||||||||||||||||||||||

| Benchmark | CRISIL Hybrid 50+50 – Moderate Index TRI | |||||||||||||||||||||||

| Fund Manager | Mr. Siddharth Bothra (For Equity Component) Mr. Abhiroop Mukherjee (For Debt Component) | |||||||||||||||||||||||

| About Fund Manager |

Mr. Siddharth Bothra- Mr Siddharth Bothra has a rich experience of more than 17 years in the field of research and investments. Prior to joining Motilal Oswal AMC he had an extensive stint with Motilal Oswal Securities Ltd as senior analyst in the institutional equities division covering various sectors. During his stint with Motilal Oswal Securities Mr. Bothra won various recognition such as: ZEE Business TV - India’s Best Analyst Awards 2009 Infrastructure, ET Reuters Starmine Awards No.1 Earnings Estimator 2009 Real Estate & No. 2 Stock Picker 2010 Real Estate. He has also worked with broking outfits like Achemy Share & Stocks and VCK Share & Stocks in the past. He has done his Post Graduate Program (PGP) from Indian School of Business (ISB), Hyderabad, which included an international MBA exchange program with NYU Stern Leonard N. Stern School of Business, New York. Mr. Abhiroop Mukherjee : He is B.com (H), MBA with 10 years of experience in Trading Fixed Income Securities viz. G-sec, T-bills, Corporate Bonds CP, CD etc. He has earlier worked with PNB GILTS LTD. as a WDM Dealer for the period 2007-2011 Other Funds Managed by Mr. Abhiroop Mukherjee: He is the Fund manager for the debt component of Motilal Oswal Focused 25 Fund, Motilal Oswal Midcap 30 Fund, Motilal Oswal Multicap 35 Fund and Motilal Oswal Long Term Equity Fund. |

|||||||||||||||||||||||

| Entry / Exit Load | Entry : Nil Exit Load: 1% - If redeemed on or before 1 year from the date of allotment. Nil - If redeemed after 1 year from the date of allotment. There would be no exit load for redemption of units on or before completion of 1 year from the date of allotment upto 12% of units allotted. Redemption of units would be done on First in First out Basis.A switch-out or a withdrawal shall also be subjected to the Exit Load like any Redemption. No Exit Load applies for switch between Motilal Oswal Focused 25 Fund, Motilal Oswal Midcap 30 Fund, Motilal Oswal Flexi Cap Fund, Motilal Oswal Equity Hybrid Fund, Motilal Oswal Large And Midcap Fund, Motilal Oswal Dynamic Fund & Motilal Oswal Multi Asset Fund. No Load for switch between Options within the Scheme. Further, it is clarified that there will be no exit load charged on a switch-out from Regular to Direct plan within the same scheme | |||||||||||||||||||||||

| Asset Allocation |

|

|||||||||||||||||||||||

| MOVI | Motilal Oswal Value Index (MOVI) is a proprietary index of Motilal Oswal Asset Management Company Limited (MOAMC). It is calculated taking into account Price to Earnings (P/E), Price to Book (P/B) and Dividend Yield of the Nifty 50 Index. The MOVI is calculated on 30 Daily Moving Average of the above parameters. A low MOVI level indicates that the market valuation appears to be cheap and one may allocate a higher percentage of their investments to Equity as an asset class. A high MOVI level indicates that the market valuation appears to be expensive and that one may reduce their equity allocation. NSE Indices Ltd. (NSE) is the calculating agent of NIFTY MOVI. NSE shall calculate, compile, maintain and provide NIFTY MOVI values to Motilal Oswal Asset Management Company Ltd. NIFTY MOVI values will be published on the MOAMC website on a daily basis. | |||||||||||||||||||||||

| Plans | Regular Plan and Direct Plan | |||||||||||||||||||||||

| Options (Under each plan): | Dividend (Payout and Reinvestment) and Growth | |||||||||||||||||||||||

| Minimum Application Amount: | Rs. 500/- and in multiples of Re. 1/- thereafter | |||||||||||||||||||||||

| Additional Application Amount: | Rs. 500/- and in multiples of Re. 1/- thereafter | |||||||||||||||||||||||

| Systematic Investment Plan(SIP) |

|

|||||||||||||||||||||||

| Minimum Redemption Amount | Rs. 500/- and in multiples of Re. 1/- thereafter or account balance, whichever is lower | |||||||||||||||||||||||

| Product Labeling |

|

| This product is suitable for investors who are seeking | |

| 1) Long-term capital appreciation | |

| 2) Investment in equity, derivatives and debt instruments | |

| *Investors should consult their financial advisers if in doubt about whether the product is suitable for them. |