Introducing

Motilal Oswal 5 Year G-Sec FoF

(An open ended fund of funds scheme investing in units of Motilal Oswal 5 Year G-Sec ETF)

5 Benefits for a bright future

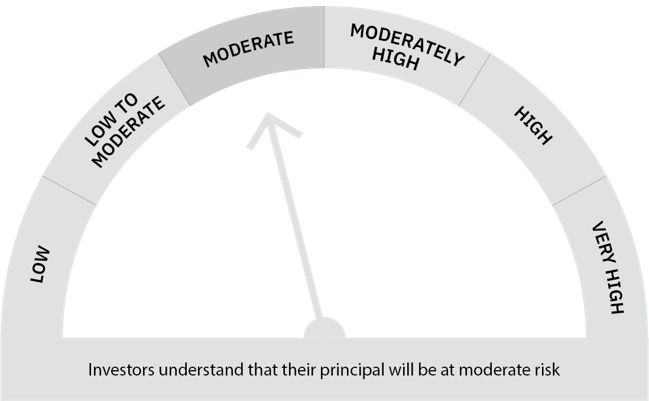

- Low Risk: Exposure to Government backed securities

- Liquid: Underlying G-Sec is one of the most liquid security

- Economical: Invests into low cost passive fund

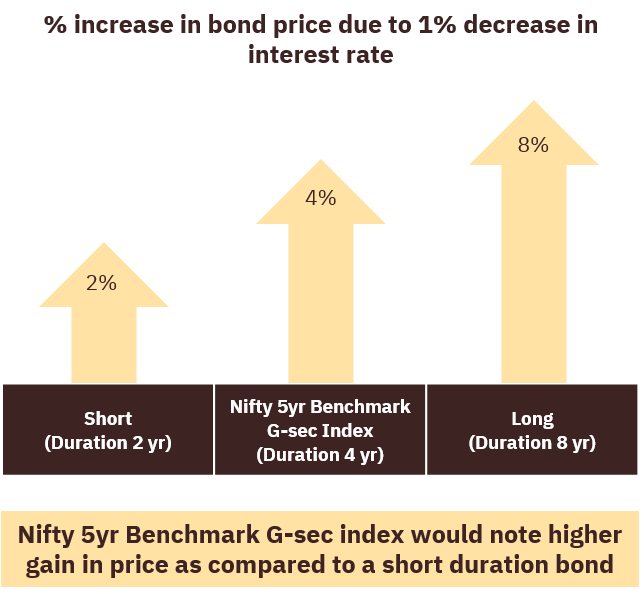

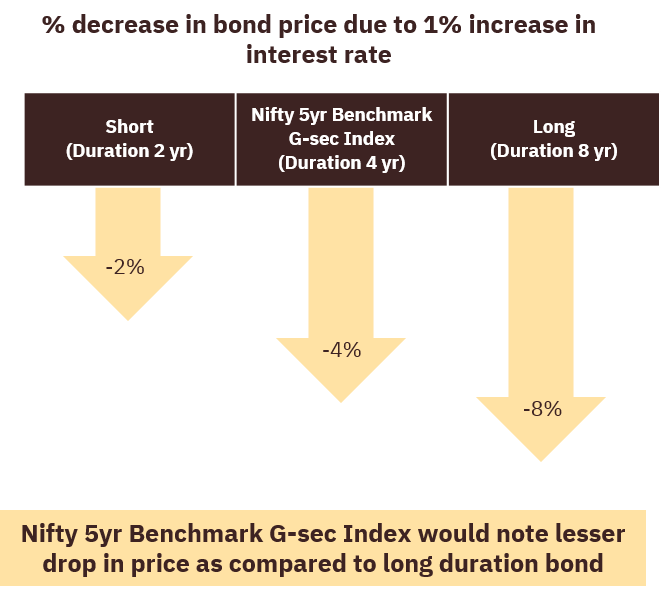

- Balanced Tenure: Falls in a sweet spot between short & long duration

- Simple: Easy access to Govt Debt Security