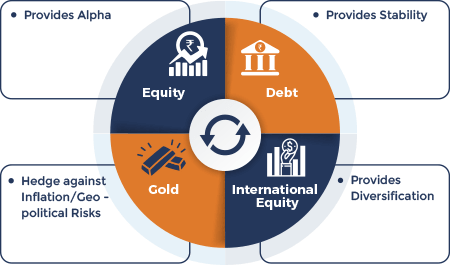

Every asset class has a role to play and contributes its own set of properties to give us a final asset allocation with properties much different from the properties of the original ingredients.

| Instruments | Allocations (% of total assets) |

Risk Profile | |

|---|---|---|---|

| Minimum | Maximum | High / Medium / Low | |

| Equity, Equity related instruments and International Equity Index Funds/ Equity ETFs^ | 10 | 50 | High |

| Debt, Money Market Instruments | 40 | 80 | Medium |

| Gold Exchange Traded Funds | 10 | 20 | Medium |

^As per SEBI Circular no. SEBI/HO/IMD/DF3/CIR/P/2017/114 dated October 6, 2017, Foreign Securities will not be treated as a separate asset class and accordingly International Equity Index Funds/Equity ETFs have been included in Equity and Equity related instruments. The scheme intends to invest in International Equity Index Funds/Equity ETFs upto 20% of net assets.

Minimum Returns

Maximum Returns

Average Returns

4.03%

16.42%

10.31%

2.25%

13.02%

6.97%

-5.01%

60.28%

16.85%

Negative Observations

0% to 4%

0

0

0%

observations

0

348

9.2%

observations

130

347

11.3%

observations

4% to 6%

6% to 8%

72

128

726

1694

258

305

8% to 10%

10% to 12%

12% to 14%

14% to 16%

Above 16%

1630

1376

463

101

18

94.7%

observations

704

249

67

0

0

26.9%

observations

342

419

376

285

1375

73.8%

observations

Source: Bloomberg and MOAMC Internal research. Disclaimer: The above data is used to explain the concept and is for illustration purpose only and should not used for development or implementation of an investment strategy. Past performance may or may not be sustained in future.

Backtested, hypothetical or simulated performance results have inherent limitations. Simulated results are achieved by the retroactive application of a backtested model itself designed with the benefit of past observations. The backtesting of performance differs from the actual account performance because the investment strategy may be adjusted at any time, for any reason and can continue to be changed until desired or better performance results are achieved. Alternative modeling techniques or assumptions might produce significantly different results and prove to be more appropriate. Past hypothetical backtest results are neither an indicator nor a guarantee of future returns. Actual results will vary from the analysis. Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, expressed or implied is made regarding future performance.

With "0%" of observations below 4% and ~ 95% of observations falling in above 8% returns for 3 year rolling period across 18 years test case period

Total number of observations are 3788. Returns are calculated on a daily rolling basis. Back-test returns are gross of expenses.

|

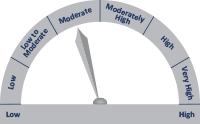

Riskometer

Investors understand that their principal will be at |

|