Why Motilal Oswal Manufacturing Fund?

Did You Know?

Source: MOAMC Internal

Why Manufacturing?

Momentum

Reforms

Make In India

Sunrise Sectors

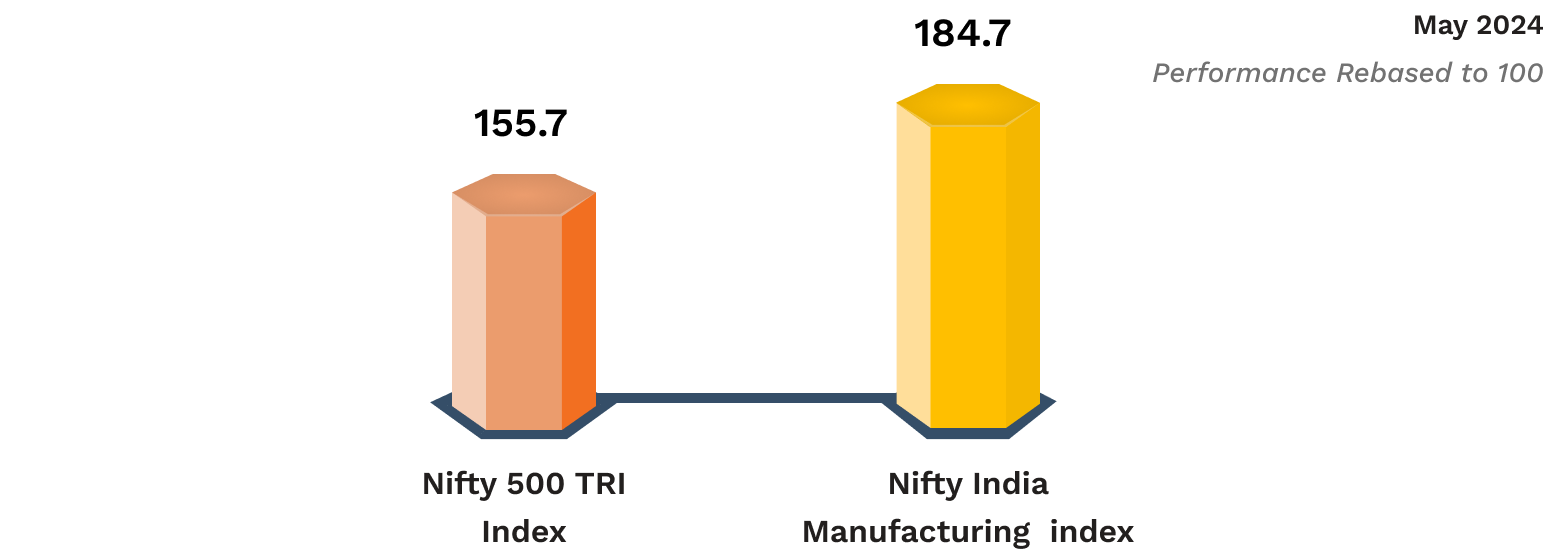

With just 75 stocks, the Nifty India Manufacturing index has outpaced the Nifty 500 TRI by 11.4% within 2 years

Source: Nifty Indices, MOIE, Ace MF. Past performance may or may not be sustained in future. The above graph is used to explain the concept and is for explanatory purpose only and should not used for development or implementation of an investment strategy. Read more...

Want to Know more about the Motilal Oswal Manufacturing Fund?

Here's what our Fund Manager, Ajay Khandelwal has to say.

Fund Name

Plans

Options (Under each plan)

Benchmark

Minimum Application Amount

Minimum Redemption Amount

Investment Objective

To achieve long term capital appreciation by predominantly investing in equity and equity related instruments of companies engaged in the manufacturing activity.

However, there can be no assurance that the investment objective of the scheme will be realized.

Type

Entry load

Exit load

1% - If redeemed on or before 3 Months from the date of allotment. Nil - If redeemed after 3 Months from the date of allotment. Exit Load will be applicable on switch amongst the Schemes of MOMF. No Load shall be imposed for switching between Options within the Scheme. Further, it is clarified that there will be no exit load charged on a switch-out from Regular to Direct plan within the same scheme.

Fund Managers

FAQs

What are the Key Dates and information about Motilal Oswal Manufacturing NFO?

Dates:

- Opening Date: 19th July 2024

- Closing Date: 2nd August 2024

- Allotment Date: 8th August 2024

- Reopening Date: 14th August 2024

Information:

- Units Allotment: Units for investments received during the NFO period will be allotted at an NAV of Rs. 10.

- First NAV Declaration: The first NAV will be declared on the reopening date, 14th August 2024, at 11:00 PM.

- Stamp Duty Deduction: A stamp duty of 0.005% will be deducted from the investment amount. For example, if you invest Rs.1000, units will be allotted for Rs.999.95 after deducting the stamp duty, resulting in 99.995 units.

- Units Reflection in Portfolio: The allotted units will reflect in your portfolio starting from 9th August 2024.

- Ongoing Purchases: You can make ongoing purchases in the scheme from the reopening date, 14th August 2024.

- SIP Instalments: For SIPs registered during the NFO period, the first instalment dates are:

- Physical SIP: 29th August 2024

- Online SIP: 19th August 2024

- Expense Ratio: The expense ratio of the scheme will be available on our website starting from 14th August 2024.