OUR NATION IS INVESTING IN DEFENCE

Source: Nomura Defence sector report. The above graph is used to explain the concept and is for illustration purpose only and should not used for development or implementation of an investment strategy.

HELPING THE DEFENCE SECTOR GROW RAPIDLY

Long Term outperformance

Impressive returns

Diversified portfolio

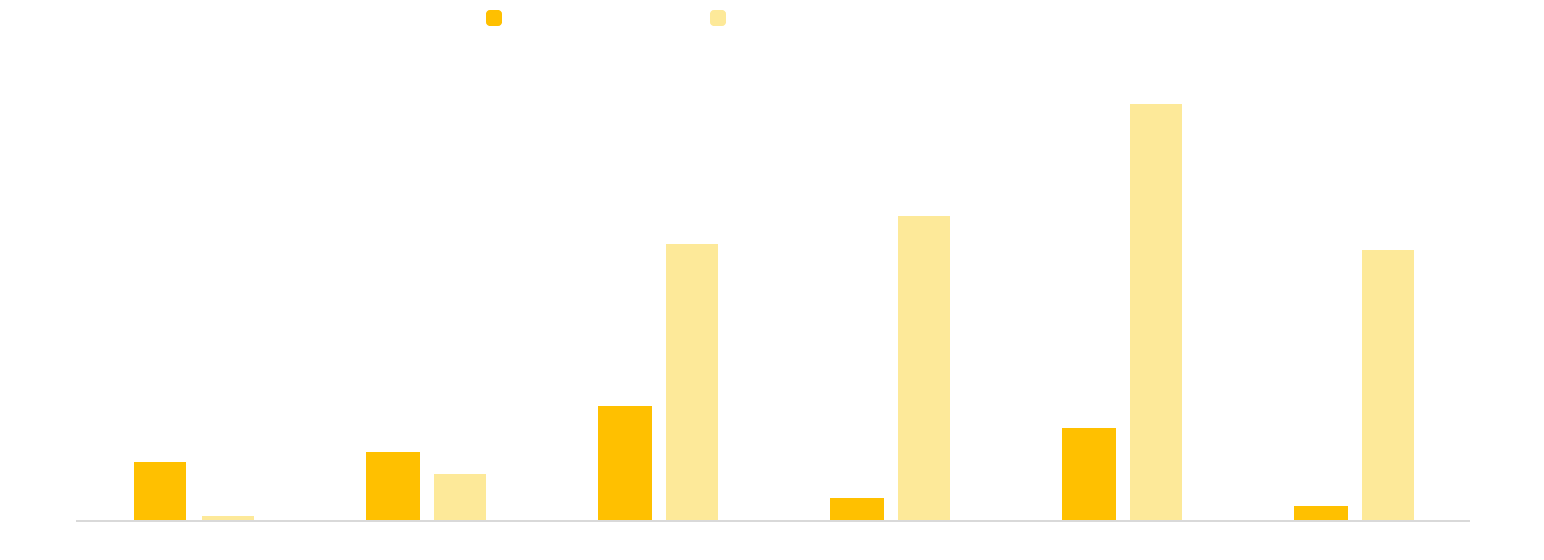

Nifty India Defence Index has outperformed Nifty 50 four times in recent six calendar years

Source/Disclaimer: Nifty Indices. Performance as of close of 31-Dec-19 to 31-May-24 . Performance results have many inherent limitations and no representation is being made that any investor will, or is likely to achieve. Past performance may or may not be sustained in future. The above graph is used to explain the concept and is for illustration purpose only and should not used for development or implementation of an investment strategy.

AIM TO BENEFIT BY INVESTING IN THIS SECTOR'S INDEX

5 year index CAGR of over 55%

Pure exposure to defence stocks

Sector is driven by make in india initiative

Want to Know more about the Motilal Oswal Nifty INDIA Defence index fund?

Here's what Pratik Oswal, Chief of Passive Business, has to say.

Fund Name

Plans

Options (Under each plan)

Benchmark

Minimum Application Amount

Minimum Redemption Amount

Investment Objective

The investment objective of the scheme is to provide returns that, before expenses, correspond to the total returns of the securities as represented by Nifty India Defence Total Return Index, subject to tracking error.

However, there can be no assurance or guarantee that the investment objectives of the scheme will be achieved.

Type

Entry load

Exit load

1%- If redeemed on or before 15 days from the date of allotment.

Nil- If redeemed after 15 days from the date of allotment

Fund Managers

FAQs

What is the Nifty India Defence Index Fund?

Why should I invest in the Nifty India Defence Index Fund?

• Benefit from the robust growth of the defence sector.

• Gain exposure to companies with strong government support and favourable policy initiatives.

• Invest in a sector with technological innovation and resilience against economic downturns.

• Align your portfolio with the nation's strategic priorities.

How does the Nifty India Defence Index Fund differ from the Nifty 50 Index Fund?

The Scheme being an index scheme follows a passive investment technique and shall only invest in Securities comprising one selected index irrespective of its market conditions.