Don't Time the Market. Take Time in the Market.

What are factors & how do they work?

A factor is any characteristic that helps explain the long term risk and return performance of an asset. Factors funds establish a set of rules to help select a portfolio of companies. The rules for a particular factor fund are defined by certain descriptors, for example 6M / 12M Price return for the Momentum factor. Factor funds apply these rules periodically to create an optimized portfolio of stocks, eliminating all ambiguity.

Select A factor fund of your choice

Compare Funds

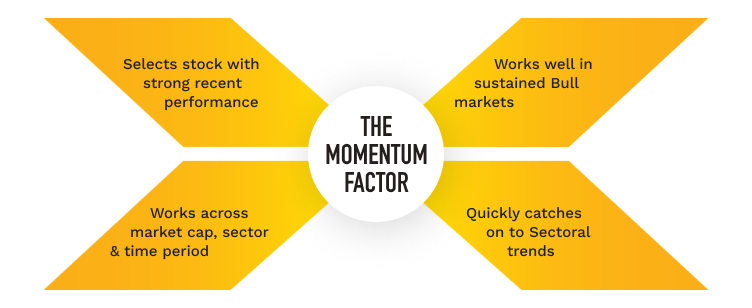

The Momentum Factor

The Low Volatility Factor

The Quality Factor

The Value Factor

The Momentum factor exploits the tendency of winning stocks to continue performing well in the near term

Measured using: 6M Return, 12M Return