Don't Time the Market. Take Time in the Market.

Introduction

Sugar, Salt, & Spice are essential in enhancing the taste of your favourite food. Similarly, Factor funds could be the ingredients necessary to enhance your portfolio returns.

What are factors & how do they work?

A factor is any characteristic that helps explain the long term risk and return performance of an asset. Factors funds establish a set of rules to help select a portfolio of companies. The rules for a particular factor fund are defined by certain descriptors, for example 6M / 12M Price return for the Momentum factor. Factor funds apply these rules periodically to create an optimized portfolio of stocks, eliminating all ambiguity.

Factor Investing offers the Best of both worlds

Factor investing sits between Active and Passive investing and looks to combine the best of both worlds

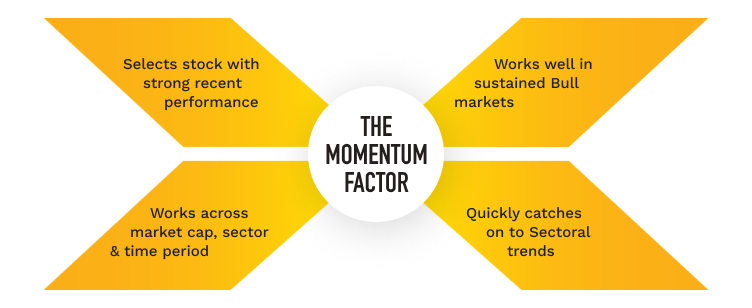

The Momentum Factor

The Low Volatility Factor

The Quality Factor

The Value Factor

The Momentum factor exploits the tendency of winning stocks to continue performing well in the near term

Measured using: 6M Return, 12M Return

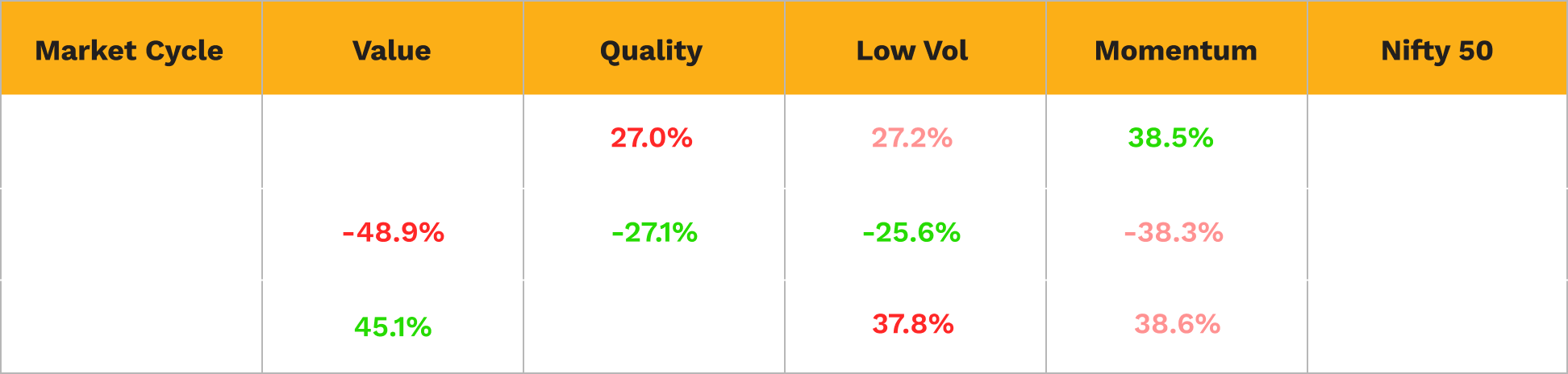

Different Factors work in different Market cycles

Momentum tends to significantly outperform in Bull market cycles

Momentum tends to significantly outperform in Bull market cycles Quality and Low Vol offer good downside protection and tend to outperform in Bear markets

Quality and Low Vol offer good downside protection and tend to outperform in Bear markets Value tends to outperform when the market is recovering from a bear phase

Value tends to outperform when the market is recovering from a bear phase

Low Vol= S&P BSE Low Volatility TRI, Quality= S&P BSE Quality TRI, Momentum= S&P BSE Momentum TRI, Value= S&P BSE Enhanced Value TRI. source/Disclaimer: MOAMC Research; Data as of 31-March-2024. The information/ data herein alone is not sufficient and should not be usec for implementation of an investment strategy. The table/charts mentioned above are used to explain the concept and is for illustration purpose only. It should not be construed as an investment advice to any party. Past performance may or may not be sustained in the future.