A Systematic Investment Plan (SIP) lets you invest small amounts in mutual funds regularly, building wealth over time without a large initial investment.

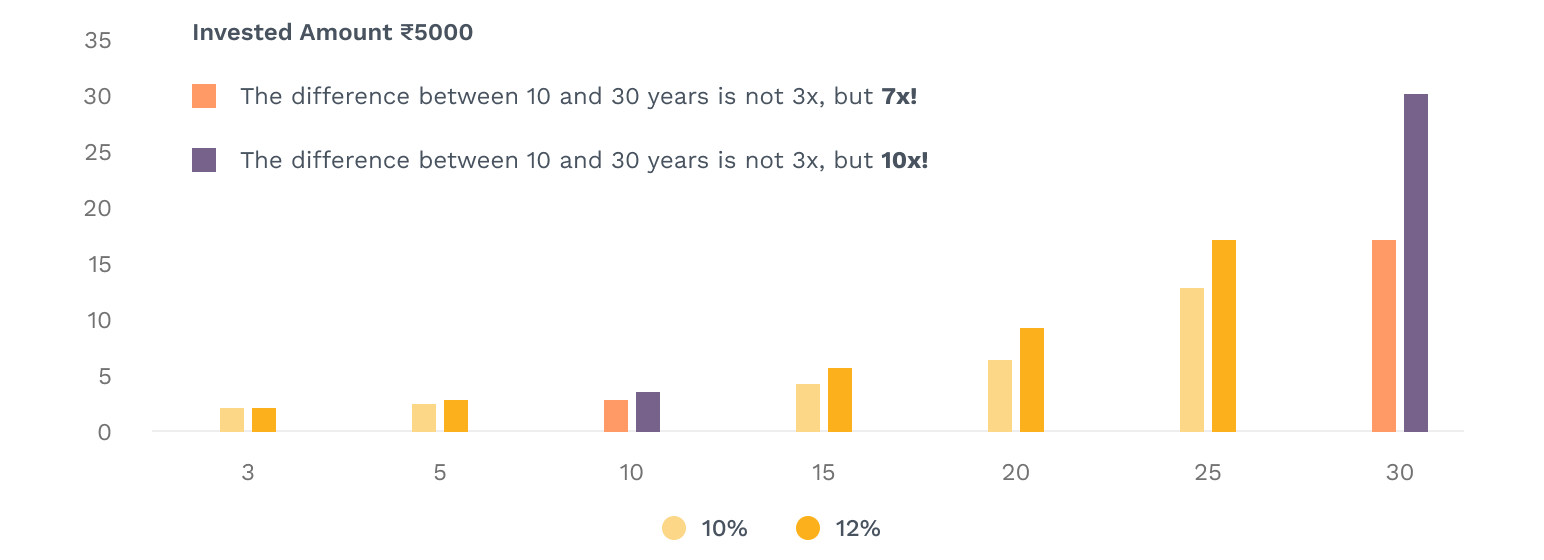

Starting a SIP early fosters saving habits and utilises rupee cost averaging and compounding. Invest as low as Rs. 500 monthly to grow your wealth.

Use your investments to fulfil your desired goals” instead of use your investments for goals like buying house, a car, or planning for retirement.