What is Business

Cycle Investing?

This investment strategy focuses on generating wealth by choosing companies likely to perform well in the current phase of the business cycle

Why Motilal Oswal

Business Cycle Fund?

Why should you invest in Business Cycle?

Leverages Expansion Opportunity

Provides Optimum Sector Rotation

India: Vicious to Virtuous Cycle

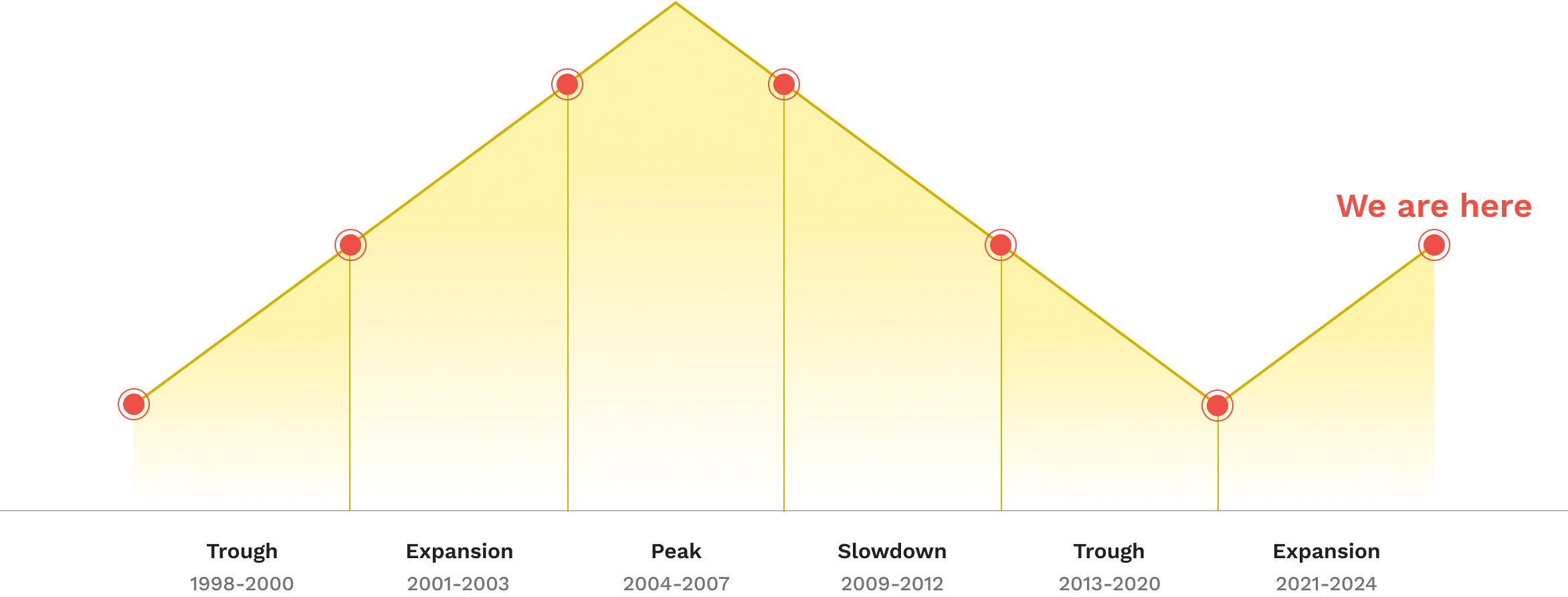

Business cycle investing identifies & invests only

during the expansion phase of a business

Source: MOAMC Internal, NSE Indices'. The Stocks/Sectors mentioned above are used to explain the concept and is for illustration purpose only and should not be used for development or implementation of any investment strategy. It should not be construed as investment advice to any party. The stocks may or may not be part of our portfolio/strategy/ schemes.

India’s Economic Cycle

Source: MOAMC Internal. The above list is illustrative and not exhaustive, there may be several other characteristics observed during each phase. It should not be construed as investment advice to any party.

Want to Know more about the Motilal Oswal Business Cycle Fund?

Here's what our Fund Manager, Niket Shah has to say.

Fund Name

Plans

Options (Under each plan)

Benchmark

Minimum Application Amount

Minimum Redemption Amount

Investment Objective

To achieve long term capital appreciation by predominantly investing in equity and equity related instruments of companies by investing with a focus on riding business cycles through allocation between sectors and stocks at different stages of business cycles.

However, there can be no assurance that the investment objective of the scheme will be realized.

Type

Entry load

Exit load

Fund Managers

FAQs

What are the Key Dates and information about Motilal Oswal Business Cycle Fund NFO?

- Opening Date: 7th August 2024

- Closing Date: 21st August 2024

- Allotment Date: 27th August 2024

- Reopening Date: 02nd September 2024

Important Information:

- Units Allotment: Units for investments received during the NFO period will be allotted at an NAV of Rs. 10.

- First NAV Declaration: The first NAV will be declared on the reopening date, 02nd September 2024, at 11:00 PM.

- Stamp Duty Deduction: A stamp duty of 0.005% will be deducted from the investment amount. For example, if you invest Rs.1000, units will be allotted for Rs.999.95 after deducting the stamp duty, resulting in 99.995 units.

- Units Reflection in Portfolio: The allotted units will reflect in your portfolio starting from 28th August 2024.

- Ongoing Purchases: You can make ongoing purchases in the scheme from the reopening date, 02nd September 2024.

- SIP Instalments: For SIPs registered during the NFO period, the first instalment dates are:

- Physical SIP: 17th September 2024

- Online SIP: 10th September 2024

- Expense Ratio: The expense ratio of the scheme will be available on our website starting from 02nd September 2024.

We are committed to serve you and will keep you updated with the latest information.

Warm Regards,

Motilal Oswal Mutual Fund

What is Business Cycle?

A business cycle refers to economic transition from periods of growth and decline over time.

What is Business Cycle investing?

Different companies and sectors react uniquely to each phase of the business cycle, hence choosing companies likely to perform well by early tapping business cycles.

Why Business Cycle?

- Diversification: Business Cycle funds offer a diverse portfolio by investing in companies of varying sizes and sectors. This approach to diversification reduces risk by distributing investments across multiple sectors, reducing the risk or impact of underperformance in a particular market segment or sector.

- Flexibility: These funds have the flexibility to rebalance the portfolio based on the market conditions within the asset allocation limits.

- Growth potential: By investing in companies of different sizes. This comprehensive approach allows Business Cycle Funds to benefit from a broader range of market dynamics and opportunities.

- Risk Management: The diversified nature of Business Cycle Funds can significantly reduce risk compared to investing exclusively in one market segment. By spreading investments across Large, Mid, and Small Caps, these funds are less vulnerable to the volatility. This broad exposure ensures that poor performance in one area can be offset by better performance in another, leading to a more balanced and stable investment experience.

Why Motilal Oswal Business Cycle Fund?

- Expertise - With a proven and lengthy track record spanning two decades, MOAMC has consistently demonstrated the ability to create wealth through early identification and investment in Large, Mid and Small Caps. The firm's extensive experience in fund management has led to the identification of numerous multi-baggers.

- High Quality & High Growth Investing - Our core investment philosophy of QGLP (Quality, Growth, Longevity and Price), reinforced by robust risk management processes drives the creation of high quality, high growth portfolios to manage all our assets. Combination of high quality and high growth is the sweetest spot. Founded on a set of principles and beliefs that guide our investment decisions we firmly believe that this philosophy is a key driver of long-term financial success for our clients.

- Skin in the Game – Demonstrating our strong conviction in our funds, MOAMC has made prop investments exceeding 7,500+ crores across our funds*. This commitment is mirrored by the promoters' dedication to investing during the Multi Cap NFO, aligning with our strategy and conviction. *Data as on 30th June, 2024.

- Size Advantage - Our fresh portfolio is meticulously curated to capture the best opportunities and future growth potential.

- Growth Themes - Our investment strategy focuses on in-house identified themes driven by domestic growth and thriving in a supportive policy environment. This forward-looking approach ensures alignment with dynamic market conditions and emerging opportunities.

- Our Process, Your Success - "Our Process, Your Success" signifies our unwavering adherence to proven processes developed over decades of equity research and investing experience with a clear objective of charting a seamless path to your financial success.

The Scheme being an index scheme follows a passive investment technique and shall only invest in Securities comprising one selected index irrespective of its market conditions.