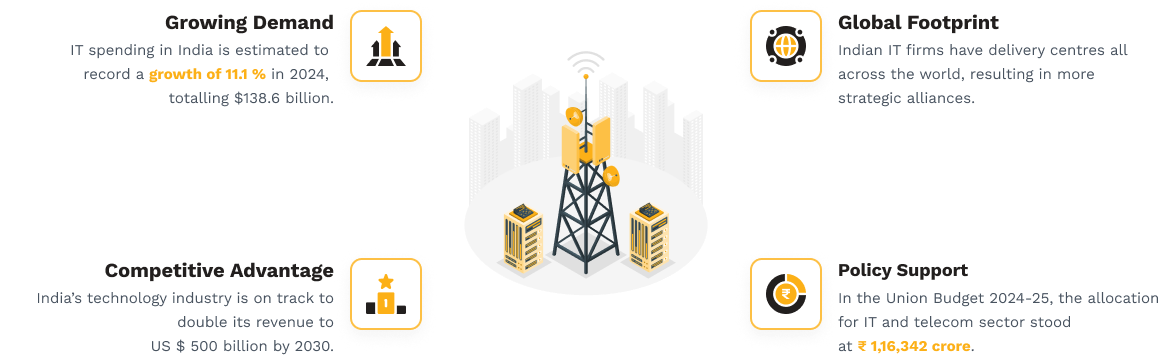

IT & Telecom - Growth Potential

Source/Disclaimer: IBEF sector report. The above graph is used to explain the concept and is for illustration purpose only and should not used for development or implementation of an investment strategy. Past performance may not e sustained in the future and is not a guarantee of any future returns.

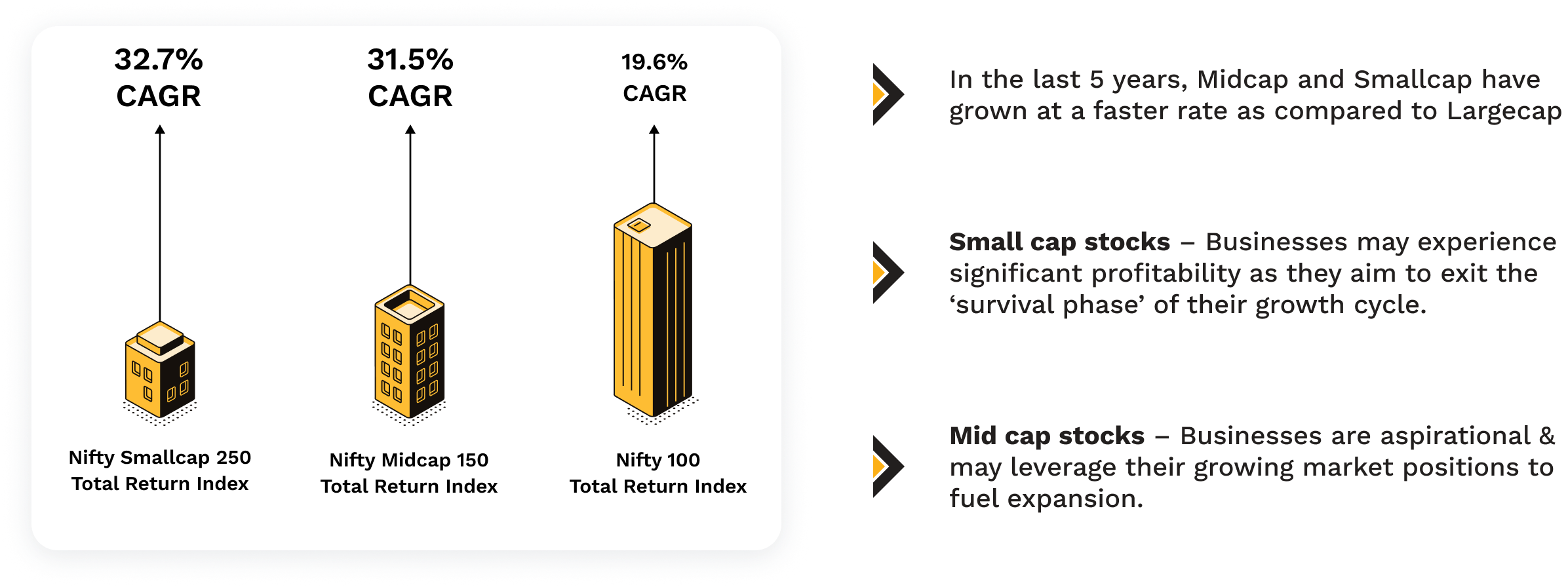

Mid & Small cap stocks saw better growth in 5 years

Source: nifty indices, Data from 30-Sep-2019 to 30-Sep-2024. The above graph is used to explain the concept and is for illustration purpose only and should not used for development or implementation of an investment strategy. Past performance may not be sustained in the future . Profitability = Profit after tax (PAT) Profitability = Profit after tax (PAT). CAGR = Compounded Annual Growth Rate. In general large cap are less volatile as compared to mid cap and small cap, investors should consider risk profile while investing.

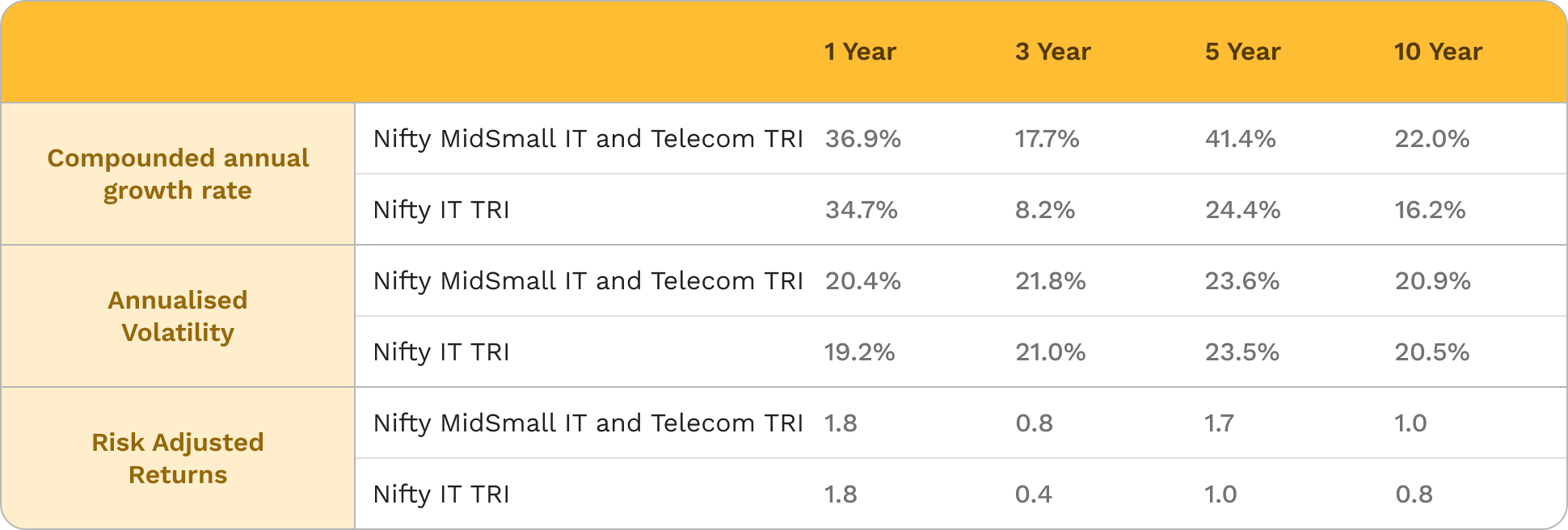

IT and Telecom MidSmall vs Broad Index

Source/Disclaimer: niftyindices: Performance as of close of 30-Sep-14 to 30-Sep-24. Performance results have many inherent limitations and no representation is being made that any investor will, or is likely to achieve. Past performance may or may not be sustained in future and is not a guarantee of any future return. The above graph is used to explain the concept and is for illustration purpose only and should not used for development or implementation of an investment strategy. TRI= Total Return Index.

Fund Name

Plans

Options

Benchmark

Minimum Application Amount

Minimum Redemption Amount

Investment Objective

The investment objective of the scheme is to provide returns that, before expenses, correspond to the total returns of the securities as represented by Nifty MidSmall IT and Telecom Total Return Index, subject to tracking error.

However, there can be no assurance or guarantee that the investment objectives of the scheme will be achieved.

Type

Entry load

Exit load

1% if redeemed on or before 15 days of allotment.

Nil- If redeemed after 15 days from the date of allotment.

Fund Managers

FAQs

What is the Nifty MidSmall IT & Telecom Index Fund?

The Nifty MidSmall IT & Telecom Index Fund is a mutual fund that tracks the performance of the Nifty MidSmall IT & Telecom Index. The index comprises mid and small-cap companies in the Information Technology (IT) and Telecom sectors, offering investors exposure to growing companies within these industries.

Who should invest in the Nifty MidSmall IT & Telecom Index Fund?

Investors with a higher risk appetite, looking for long-term capital appreciation, and those seeking exposure to mid and small-cap companies within the IT and Telecom sectors should consider this fund.

What are the risks associated with this fund?

- • Higher volatility: Mid and small-cap companies may see significant price swings.

- • Sector concentration: Since the fund focuses solely on IT and Telecom sectors, it is more susceptible to downturns in these industries.

- • Liquidity risk: Smaller companies may have lower trading volumes, making them more difficult to buy or sell quickly.

The Scheme being an index scheme follows a passive investment technique and shall only invest in Securities comprising one selected index irrespective of its market conditions.