Motilal Oswal Equity Hybrid Fund

(An open ended hybrid scheme investing predominantly in equity and equity related instruments)July 2023

Fund Manager |

For Equity Component Mr. Santosh Singh* He is managing this fund since 01-Aug-2023. He has close to 15 years of experience For Debt Component Mr. Rakesh Shetty Managing this fund since 22-Nov-2022 He has a rich experience of more than 14 years *With effect from close of business hours of 31-July-2023, *Mr. Siddharth Bothra has ceased to be the Fund Manager. |

Benchmark: |

CRISIL Hybrid 35 + 65 - Aggressive Index |

Monthly AAUM |

₹ 414.10 cr |

|---|---|

Latest AUM (31-July-2023) |

₹ 417.55 cr |

Market Capitalization |

|

Market Cap |

Weightage (%) |

| Large Cap | 71% |

| Mid Cap | 23% |

| Small Cap | 7% |

Top 5 Stocks |

|

Stocks |

(%) of Holding |

| HDFC Bank Ltd. | 6.6 |

| Abbott India Ltd | 5.8 |

| Zomato Ltd | 5.5 |

ABB India Ltd |

4.7 |

ICICI Bank Ltd |

4.5 |

| Category | Aggressive Hybrid Fund |

| Date of Allotment | 14-Sep-2018 |

| Continuous Offer | Minimum Application Amount : ₹ 500/- and in

multiples of ₹1 /- thereafter. Additional Application Amount : ₹ 500/- and in multiples of ₹1/- thereafter. |

| Redemption proceeds | Normally within 2 Business days from acceptance of redemption request. |

| Entry / Exit Load | Entry Load: Nil Exit Load: 1% - If redeemed on or before 15 days from the date of allotment. Nil - If redeemed after 15 days from the date of allotment. A switch-out or a withdrawal shall also be subjected to the Exit Load like any Redemption. No Exit Load applies for switch between Motilal Oswal Focused Fund, Motilal Oswal Midcap Fund, Motilal Oswal Flexi Cap Fund, Motilal Oswal Equity Hybrid Fund, Motilal Oswal Large and Midcap Fund, Motilal Oswal Multi Asset Fund & Motilal Oswal Balanced Advantage Fund. No Load for switch between Options within the Scheme. Further, it is clarified that there will be no exit load charged on a switch-out from Regular to Direct plan within the same scheme. |

| Investment Objective | The investment objective is to generate equity linked returns

by investing in a combined portfolio of equity and equity

related instruments, debt, money market instruments and

units issued by Real Estate Investment Trust (REITs) and

Infrastructure Investment Trust (InvITs). However, there can be no assurance or guarantee that the investment objective of the Scheme would be achieved. |

| Total Expenses Ratio | Direct: 0.91% Regular: 2.42% |

Scrip |

Weightage

(%) |

| Equity & Equity Related | |

| HDFC Bank Ltd. | 6.6% |

| Abbott India Ltd. | 5.8% |

| Zomato Ltd. | 5.5% |

| ABB India Ltd. | 4.7% |

| ICICI Bank Ltd. | 4.5% |

| Reliance Industries Ltd. | 4.4% |

| Avenue Supermarts Ltd. | 4.3% |

| Vedant Fashions Ltd. | 3.6% |

| KFin Technologies Ltd. | 3.5% |

| Pidilite Industries Ltd. | 2.7% |

| Infosys Ltd. | 2.6% |

| UltraTech Cement Ltd. | 2.5% |

| ICICI Lombard General Insurance Company Ltd. | 2.4% |

| Larsen & Toubro Ltd. | 2.3% |

| HDFC Life Insurance Company Ltd. | 2.3% |

| Hindustan Aeronautics Ltd. | 2.1% |

| Kotak Mahindra Bank Ltd. | 2.1% |

| The Indian Hotels Company Ltd. | 1.9% |

| Metro Brands Ltd. | 1.9% |

| One 97 Communications Ltd. | 1.8% |

| Eicher Motors Ltd. | 1.7% |

| Fino Payments Bank Ltd. | 1.6% |

| L&T Technology Services Ltd. | 1.4% |

| Bharti Airtel Ltd. | 1.4% |

| PI Industries Ltd. | 1.3% |

| Devyani International Ltd. | 0.9% |

| Bosch Ltd. | 0.8% |

| Total | 76.8% |

| Jio Financial Services Ltd. | 0.4% |

| Total | 0.4% |

| Debt Instruments | 19.0% |

| REC Ltd. | 3.6% |

| Shriram Finance Ltd. | 3.6% |

| Muthoot Finance Ltd. | 3.6% |

| Mahindra & Mahindra Financial Services Ltd. | 3.6% |

| Indian Oil Corporation Ltd. | 3.6% |

| National Bank For Agriculture and Rural Development | 1.2% |

| Money Market Instrument | 1.2% |

| Kotak Mahindra Bank Ltd. 2023 | 1.2% |

| Net Receivable/Payable | 2.6% |

| Grand Total | 100% |

| Record Date | IDCW perUnit (₹) |

Cum IDCW NAV |

Ex IDCW NAV |

| Monthly IDCW (Direct Plan) | |||

31-Dec-21 |

0.0312 |

10.0612 |

10.0300 |

26-Nov-21 |

0.0262 |

10.0562 |

10.0300 |

29-Oct-21 |

0.0280 |

10.0580 |

10.0300 |

| Monthly IDCW (Regular Plan) | |||

31-Dec-21 |

0.0296 |

10.0597 |

10.0300 |

26-Nov-21 |

0.0249 |

10.0549 |

10.0300 |

29-Oct-21 |

0.0264 |

10.0564 |

10.0300 |

| Quarterly IDCW (Direct Plan) | |||

31-Dec-21 |

0.0850 |

10.0885 |

10.0034 |

24-Sep-21 |

0.0774 |

10.0808 |

10.0034 |

25-Jun-21 |

0.0754 |

10.0788 |

10.0034 |

| Quarterly IDCW (Regular Plan) | |||

31-Dec-21 |

0.0814 |

10.0848 |

10.0034 |

24-Sep-21 |

0.0742 |

10.0776 |

10.0034 |

25-Jun-21 |

0.0719 |

10.0753 |

10.0034 |

| Pursuant to payment of IDCW, NAV per unit will fall to the extent of the IDCW payout and statutory levy (if applicable). Face value ₹ 10/-. Past performance may or may not be sustained in future. | |||

1 Year |

3 Year |

Since Inception |

||||

CAGR (%) |

Current Value of Investment of ₹ 10,000 |

CAGR (%) |

Current Value of Investment of ₹ 10,000 |

CAGR (%) |

Current Value of Investment of ₹ 10,000 |

|

| Scheme | 14.2 |

11,430 |

14.6 |

15,037 |

11.4 |

16,953 |

| CRISIL Hybrid 35 + 65 - Aggressive Index (Benchmark) | 13.2 |

11,332 |

17.1 |

16,062 |

12.0 |

17,377 |

| Nifty 50 TRI (Additional Benchmark) | 16.2 |

11,628 |

22.7 |

18,479 |

13.0 |

18,159 |

| NAV (₹) Per Unit (16.9530 as on 31-July-2023) |

14.8314 |

11.2739 |

10.0000 |

|||

Date of inception: 14-Sept-18. Incase, the start/end date of the concerned period is non business date (NBD), the NAV of the previous date is considered for computation of returns. The NAV per unit shown in the table is as on the start date of the said period. Past performance may or may not be sustained in the future. Performance is for Regular Plan Growth option. Different plans have different expense structure. Mr. Santosh Singh is the Fund Manager for equity component since 01-Aug-2023 of the fund; and Mr. Rakesh Shetty is the Fund Manager for debt component Managing this fund since 22-Nov-2022

1 Year |

3 Year |

Since Inception |

|||||||

Scheme |

CRISIL Hybrid 35 + 65 - Aggressive Index |

Nifty 50 TRI* |

Scheme |

CRISIL Hybrid 35 + 65 - Aggressive Index |

Nifty 50 TRI* |

Scheme |

CRISIL Hybrid 35 + 65 - Aggressive Index |

Nifty 50 TRI* |

|

| Invested Amount | 1,20,000 |

3,60,000 |

5,80,000 |

||||||

| Market Value | 1,30,792 |

1,30,666 |

1,33,068 |

4,25,868 |

4,36,377 |

4,58,659 |

7,82,490 |

8,16,397 |

8,75,699 |

| Returns (XIRR) % | 17.18 |

16.97 |

20.90 |

11.24 |

12.93 |

16.41 |

12.37 |

14.15 |

17.12 |

| (as on 31-July-2023) | |||||||||

* Also represents additional benchmark

For SIP returns, monthly investment of ₹ 10,000/- invested on the 1st day of every month has been considered. Performance is for Regular Plan Growth Option. Past performance may or may not be sustained in the future.

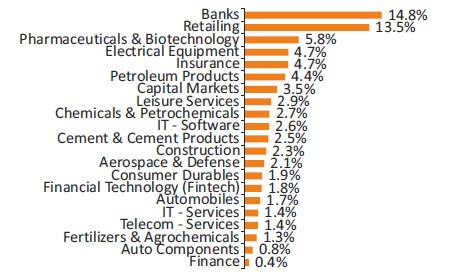

(Data as on 31-July-2023) Industry classification as recommended by AMFI

Beta |

1.0 |

Portfolio Turnover Ratio |

0.8 |

Standard Deviation |

9.8% (Annualised) |

Sharpe Ratio# |

0.9 (Annualised) |

| # Risk free returns based on last overnight MIBOR cut-off of 6.60% (Data as on 31-July-2023) | |

Regular Plan Growth Option |

₹ 16.9530 |

Direct Plan Growth Option |

₹ 18.3133 |

| (IDCW= Income Distribution cum capital withdrawal option) | |

Average Maturity |

0.78 Yrs |

YTM |

7.61% |

Macaulay Duration |

0.74 Yrs |

Modified Duration |

0.69 Yrs |

Instrument Name |

Weightage% |

| Equity | 76.8 |

| Jio Financial Services Limited | 0.4 |

| Bonds & NCDs | 19.0 |

| Money Market Instrument (CD,CBLO & Treasury Bill) | 1.2 |

| Cash & Cash Equivalents | 2.6 |

| Total | 100.0 |

Month |

Net Long Equity |

Debt* |

Total |

July-23 |

76.8% |

23.9% |

100% |

June-23 |

75.1% |

24.9% |

100% |

May-23 |

76.7% |

23.3% |

100% |

Apr-23 |

70.09% |

29.91% |

100% |

Mar-23 |

67.4% |

32.5% |

100% |

Feb-23 |

69.3% |

30.7% |

100% |

Jan-23 |

67.6% |

32.4% |

100% |

Dec-22 |

70.6% |

29.5% |

100% |

Nov-22 |

72.7% |

27.3% |

100% |

Oct-22 |

70.5% |

29.5% |

100% |

Sep-22 |

68.6% |

31.4% |

100% |

Aug-22 |

74.1% |

25.9% |

100% |

| *include CBLO & Cash & Cash Equivalents | |||

- Long term capital appreciation by generating equity linked returns

- Investment predominantly in equity and equity related instruments

RISKOMETER |

| BENCHMARK RISKOMETER CRISIL Hybrid 35 + 65 - Aggressive Index  |