Motilal Oswal Flexi Cap Fund

(An open ended dynamic equity scheme investing across large cap, mid cap, small cap stocks)July 2023

Fund Manager |

For Equity Component Mr. Niket Shah* He has been appointed as the Fund Manager for the equity component w.e.f. July 1, 2022. He has a rich experience of more than 13 years For Debt Component since Inception Mr. Rakesh Shetty Managing this fund since 22-Nov-2022 He has a rich experience of more than 14 years For Foreign Securities Mr. Ankush Sood He has been appointed as the Fund Manager for Foreign securities w.e.f. August 25, 2021. *With effect from close of business hours of 31-July-2023, *Mr. Siddharth Bothra has ceased to be the Fund Manager. |

Benchmark: |

Nifty 500 TRI |

Monthly AAUM |

₹ 8,345.66 cr |

|---|---|

Latest AUM (31-July-2023) |

₹ 8,288.31 cr |

Market Capitalization |

|

Market Cap |

Weightage (%) |

| Large Cap | 60% |

| Mid Cap | 33% |

| Small Cap | 7% |

Top 5 Stocks |

|

Stocks |

(%) of Holding |

Zomato Ltd |

9.8 |

ICICI Bank Ltd |

9.3 |

Tube Investments of India Ltd |

8.9 |

HDFC Bank Ltd |

7.2 |

Persistent Systems Ltd |

6.3 |

| Category | Flexi Cap Fund |

| Date of Allotment | 28-Apr-2014 |

| Continuous Offer | Minimum Application Amount : ₹ 500/- and in

multiples of ₹1 /- thereafter. Additional Application Amount : ₹ 500/- and in multiples of ₹1/- thereafter. |

| Redemption proceeds | Normally within 2 Business days from acceptance of redemption request. |

| Entry / Exit Load | Entry Load: Nil Exit Load: 1% - If redeemed on or before 15 days from the date of allotment. Nil - If redeemed after 15 days from the date of allotment. A switch-out or a withdrawal shall also be subjected to the Exit Load like any Redemption. No Exit Load applies for switch between Motilal Oswal Focused Fund, Motilal Oswal Midcap Fund, Motilal Oswal Flexi Cap Fund, Motilal Oswal Equity Hybrid Fund, Motilal Oswal Large and Midcap Fund, Motilal Oswal Multi Asset Fund & Motilal Oswal Balanced Advantage Fund. No Load for switch between Options within the Scheme. Further, it is clarified that there will be no exit load charged on a switch-out from Regular to Direct plan within the same scheme. |

| Investment Objective | The investment objective of the Scheme is to achieve long term capital appreciation by primarily investing in equity & equity related instruments across sectors and marketcapitalization levels. However, there can be no assurance or guarantee that the investment objective of the Scheme would be achieved. |

| Total Expenses Ratio | Direct: 0.96% Regular: 1.79% |

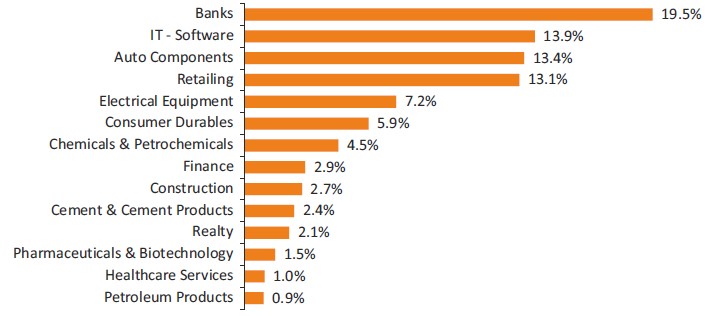

Scrip |

Weightage

(%) |

| Equity & Equity Related | |

| Zomato Ltd. | 9.8% |

| ICICI Bank Ltd. | 9.3% |

| Tube Investments of India Ltd. | 8.9% |

| HDFC Bank Ltd. | 7.2% |

| Persistent Systems Ltd. | 6.3% |

| Coforge Ltd. | 5.2% |

| Deepak Nitrite Ltd. | 4.5% |

| Balkrishna Industries Ltd. | 4.4% |

| Vaibhav Global Ltd. | 3.7% |

| ABB India Ltd. | 3.1% |

| Cholamandalam Investment and Finance Company Ltd | 2.8% |

| Larsen & Toubro Ltd. | 2.7% |

| Ambuja Cements Ltd. | 2.4% |

| Campus Activewear Ltd. | 2.2% |

| Prestige Estates Projects Ltd. | 2.1% |

| CG Power and Industrial Solutions Ltd. | 2.1% |

| Siemens Ltd. | 2.1% |

| Vedant Fashions Ltd. | 2.0% |

| State Bank of India | 1.9% |

| MphasiS Ltd. | 1.5% |

| Mankind Pharma Ltd. | 1.5% |

| Trent Ltd. | 1.3% |

| AU Small Finance Bank Ltd. | 1.1% |

| Reliance Industries Ltd. | 0.9% |

| Tech Mahindra Ltd. | 0.8% |

| Global Health Ltd. | 0.7% |

| Max Healthcare Institute Ltd. | 0.3% |

| Total | 91.0% |

| Jio Financial Services Ltd. | 0.1% |

| Total | 0.1% |

| Money Market Instruments | 5.7% |

| CBLO/REPO/TREPS | 5.7% |

| Net Receivable/Payable | 3.3% |

| Grand Total | 100% |

| Record Date | IDCW per Unit (₹) |

Cum IDCW NAV |

Ex IDCW NAV |

| 26-Mar-2021 | |||

| Direct Plan | 4.27 |

27.6060 |

23.3360 |

| Regular Plan | 4.02 |

27.3878 |

23.3678 |

| 29-Mar-2022 | |||

| Direct Plan | 1.64 |

24.1442 |

22.5042 |

| Regular Plan | 1.63 |

23.9586 |

22.3286 |

| 22-March-2023 | |||

| Direct Plan | 1.55 |

22.1743 |

20.6243 |

| Regular Plan | 1.53 |

21.8161 |

20.2861 |

| Pursuant to payment of IDCW, NAV per unit will fall to the extent of the IDCW payout and statutory levy (if applicable). Face value ₹ 10/-. Past performance may or may not be sustained in future. | |||

1 Year |

3 Year |

5 Year |

Since Inception |

|||||

CAGR (%) |

Current Value of Investment of ₹ 10,000 |

CAGR (%) |

Current Value of Investment of ₹ 10,000 |

CAGR (%) |

Current Value of Investment of ₹ 10,000 |

CAGR (%) |

Current Value of Investment of ₹ 10,000 |

|

| Scheme | 14.7 |

11,482 |

13.8 |

14,742 |

6.3 |

13,569 |

15.1 |

36,732 |

| Nifty 500 TRI (Benchmark) | 17.2 |

11,735 |

24.9 |

19,490 |

13.3 |

18,666 |

14.7 |

35,656 |

| Nifty 50 TRI (Additional Benchmark) |

16.2 |

11,628 |

22.7 |

18,479 |

13.0 |

18,447 |

13.7 |

32,798 |

| NAV (₹) Per Unit (36.7319 : as on 31-July-2023) |

31.9895 |

24.9160 |

27.0708 |

10.0000 |

||||

Date of inception: 28-Apr-14. Incase, the start/end date of the concerned period is non business date (NBD), the NAV of the previous date is considered for computation of returns. The NAV per unit shown in the table is as on the start date of the said period. Past performance may or may not be sustained in the future. Performance is for Regular Plan Growth option. Different plans have different expense structure. Mr. Siddharth Bothra has been appointed as the Fund Manager for equity component with effect from 19-May-2021 & Mr. Niket Shah has been appointed as the Fund Manager for equity component along with Mr. Siddharth Bothra with effect from 1-July-2022; Mr. Ankush Sood has been appointed as the Fund Manager for Foreign securities w.e.f. August 25, 2021For Debt Component Mr. Rakesh Shetty Managing this fund since 22-Nov-2022 For Foreign Securities Mr. Ankush Sood He has been appointed as the Fund Manager for Foreign securities w.e.f. August 25, 2021.

1 Year |

3 Year |

5 Year |

Since Inception |

|||||||||

Scheme |

Nifty 500 TRI |

Nifty 50 TRI* |

Scheme |

Nifty 500 TRI |

Nifty 50 TRI* |

Scheme |

Nifty 500 TRI |

Nifty 50 TRI* |

Scheme |

Nifty 500 TRI |

Nifty 50 TRI* |

|

| Invested Amount | 120,000 |

360,000 |

600,000 |

11,10,000 |

||||||||

| Market Value | 1,32,239 |

1,34,777 |

1,33,068 |

4,17,437 |

4,67,508 |

4,58,659 |

7,72,797 |

9,39,927 |

9,12,223 |

17,93,178 |

22,34,466 |

21,83,760 |

| Returns (XIRR) % | 19.54 |

23.72 |

20.90 |

9.87 |

17.76 |

16.41 |

10.07 |

18.02 |

16.79 |

10.06 |

14.57 |

14.10 |

| (as on 31-July-2023) | ||||||||||||

* Also represents additional benchmark

For SIP returns, monthly investment of ₹ 10,000/- invested on the 1st day of every month has been considered. Performance is for Regular Plan Growth Option. Past performance may or may not be sustained in the future.

Beta |

0.8 |

Portfolio Turnover Ratio |

1.2 |

Standard Deviation |

13.0% (Annualised) |

Sharpe Ratio# |

0.6 (Annualised) |

| # Risk free returns based on last overnight MIBOR cut-off of 6.60% (Data as on 31-July-2023) | |

Regular Plan Growth Option |

₹ 36.7319 |

Regular Plan IDCW Option |

₹ 23.8834 |

Direct Plan Growth Option |

₹ 40.0303 |

Direct Plan IDCW Option |

₹ 24.3992 |

| (IDCW= Income Distribution cum capital withdrawal option) | |

- Long-term capital growth

- Investment in equity and equity related instruments across sectors and market-capitalization levels.

RISKOMETER |

| BENCHMARK RISKOMETER Nifty 500 TRI  |